Brian Kuhn writes a solid posting at “Greed, Economy, and Education”

Excerpt:

I am about 60% of the way through

Freefall: America, Free Markets, and the Sinking of the World Economy by

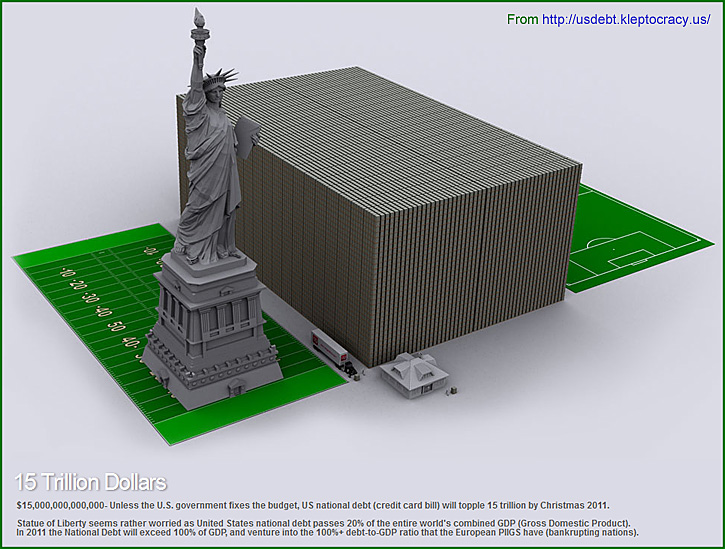

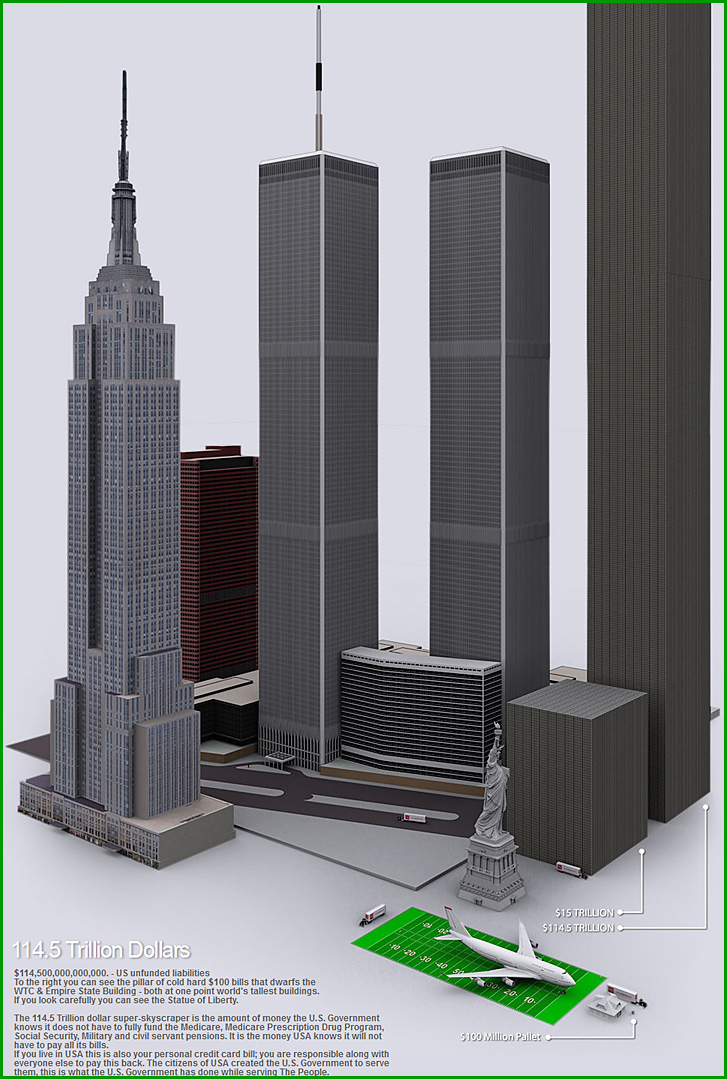

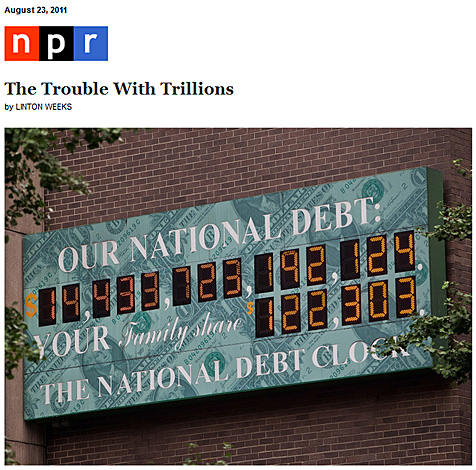

Joseph Stiglitz. Joseph is a recipient of the Nobel Memorial Prize in Economic Studies and covers this topic very thoroughly. Freefall is an fascinatingly honest retelling of the 2008 great recession and an exposing of the greed and corruption that essentially caused one of the greatest transfers of wealth in recent history. Self-serving banks loaned money to people who couldn’t afford it based on the “value” of their home growing perpetually and the government allowed it to happen. Wealth has evaporated from millions of people through loss of home and job around the world – wealth has been transferred to already very rich individuals from poor and middle class people. The US government has borrowed at unprecedented levels (the burden is on “the people”) and through bailouts given 100’s of billions of dollars to banks with virtually no strings attached due to the fear that the banks are “too big to fail”. Banks in turn paid out huge bonus and salaries to their leadership who essentially caused the failure of the financial system, toppled the economy, and ruined millions of peoples financial future and well being. Isn’t it government’s job to protect and support “the people” rather than to reward greed and failure of corporate leaders?

From DSC:

I remember posting a graphic/item on this very item back on an old website on 12/30/08:

A MUST READ: The End –from Portofolio.com, by Michael Lewis

NOTE: The language is not appropriate for kids.

From DSC:

Greed is at the heart of this matter…and speaking of hearts, we Americans need to tend to our often cold and non-caring hearts, which also contributed greatly to the problems that we are now facing. It’s a very disturbing article; and it points out the critical need for all of us to be standing on solid moral ground. Don’t get me wrong, I know that I’m a sinner (and so is everyone else) and my sin is ever before me. But when you mess with other peoples’ lives, money, and futures…you need to have your feet on some solid ground and at least strive to do the right thing!

It also points out that we Americans don’t often want to hear the truth until we have to hear the truth or until we need someone to point the finger at and blame for the issues we face. For example, how many politicians have been discarded in the past because they delivered some harsh, unpopular truth and plans of action? This same thing happened to some of the prophets of old who had to deliver some unpopular truth. Perhaps these struggles will be the 2×4 onside our collectives heads to get our attention and move towards caring about others.

Current update/further reflection from DSC (8/18/11):

When I look at this situation, I take solace in the Word that comes to us from Psalm 73:

Psalm 73

A psalm of Asaph.

1 Surely God is good to Israel,

to those who are pure in heart.

2 But as for me, my feet had almost slipped;

I had nearly lost my foothold.

3 For I envied the arrogant

when I saw the prosperity of the wicked.

4 They have no struggles;

their bodies are healthy and strong.[a]

5 They are free from common human burdens;

they are not plagued by human ills.

6 Therefore pride is their necklace;

they clothe themselves with violence.

7 From their callous hearts comes iniquity[b];

their evil imaginations have no limits.

8 They scoff, and speak with malice;

with arrogance they threaten oppression.

9 Their mouths lay claim to heaven,

and their tongues take possession of the earth.

10 Therefore their people turn to them

and drink up waters in abundance.[c]

11 They say, “How would God know?

Does the Most High know anything?”

12 This is what the wicked are like—

always free of care, they go on amassing wealth.

13 Surely in vain I have kept my heart pure

and have washed my hands in innocence.

14 All day long I have been afflicted,

and every morning brings new punishments.

15 If I had spoken out like that,

I would have betrayed your children.

16 When I tried to understand all this,

it troubled me deeply

17 [until] I entered the sanctuary of God;

then I understood their final destiny. (emphasis DSC)

18 Surely you place them on slippery ground;

you cast them down to ruin.

19 How suddenly are they destroyed,

completely swept away by terrors!

20 They are like a dream when one awakes;

when you arise, Lord,

you will despise them as fantasies.

The point is…none of us should want to be someone who “has received their reward in full (see Matthew Chapter 6)” and I’m indebted to an old friend of mine who, years ago, pointed me towards Matthew 6:33:

33 But seek first his kingdom and his righteousness, and all these things will be given to you as well.

Because if a person has had the best that they will ever have (in this life/age), I wouldn’t want to be in their shoes for what takes place in their eternity. The problem is…this type of thing is so easy to say and so hard to live out in our daily lives — especially when we see the same folks (seemingly or for real) getting wealthier all the time.