The second economy — from McKinsey Quarterly by W. Brian Arthur

Digitization is creating a second economy that’s vast, automatic, and invisible—thereby bringing the biggest change since the Industrial Revolution.

Excerpt:

We could look for one in the genetic technologies, or in nanotech, but their time hasn’t fully come. But I want to argue that something deep is going on with information technology, something that goes well beyond the use of computers, social media, and commerce on the Internet. Business processes that once took place among human beings are now being executed electronically. They are taking place in an unseen domain that is strictly digital. On the surface, this shift doesn’t seem particularly consequential—it’s almost something we take for granted. But I believe it is causing a revolution no less important and dramatic than that of the railroads. It is quietly creating a second economy, a digital one.

From DSC:

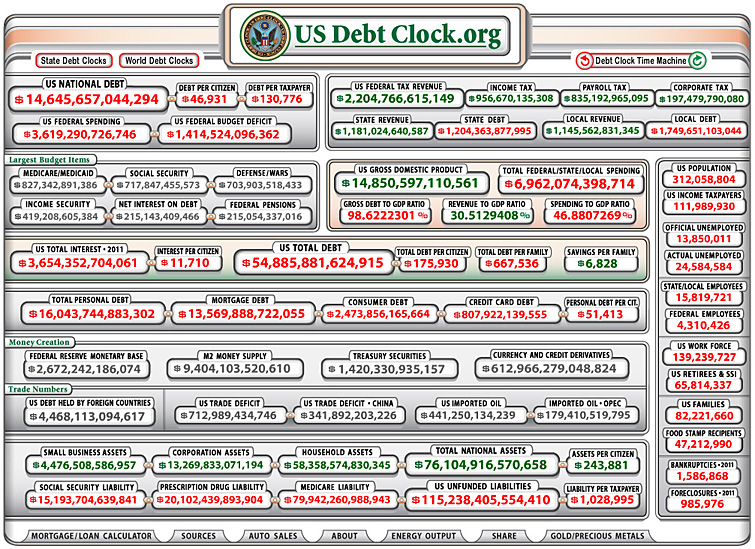

How is it that corporations are sitting on trillions of dollars (estimates vary) but the unemployment rate continues to be towards the high end of historical unemployment rates? Where’s the love and compassion for one’s fellow man? (Some of Charles Dickens’ writings in The Christmas Carol come to my mind here…)

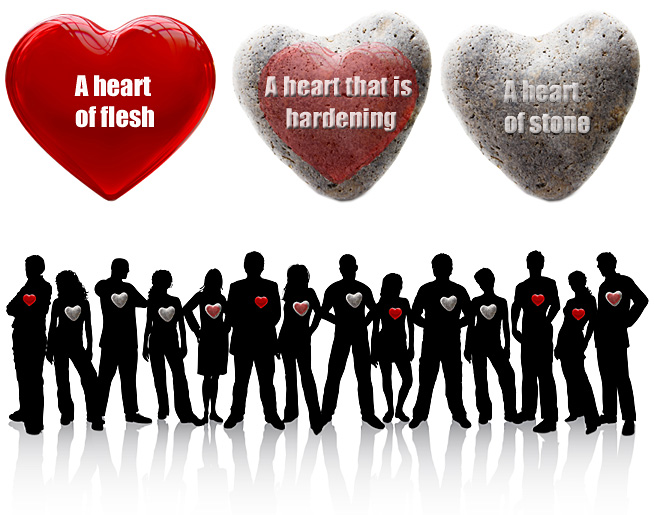

One has to ask, what’s the state of our hearts these days? Is business just about serving the almighty shareholder? Is that the ultimate goal of our businesses? Seriously…what percentage of Americans is that perspective currently benefiting? (I don’t have the answer/data, but I bet its not a majority of Americans. The lines at the soup kitchens and shelters are getting longer, not shorter.) Corporations have — today — the power to change the situation. But what’s the ultimate vision of our corporations? Who do our corporations ultimately serve?

Some relevant articles:

- Corporate profits at all-time high as recovery stumbles (March, 2011, The HuffingtonPost.com)

NEW YORK — Despite high unemployment and a largely languishing real estate market, U.S. businesses are more profitable than ever, according to federal figures released on Friday. U.S. corporate profits hit an all-time high at the end of 2010, with financial firms showing some of the biggest gains, data from the federal Bureau of Economic Analysis show. Corporations reported an annualized $1.68 trillion in profit in the fourth quarter. The previous record, without being adjusted for inflation, was $1.65 trillion in the third quarter of 2006. Many of the nation’s preeminent companies have posted massive increases in profits this year. General Electric posted worldwide profits of $14.2 billion, while profits at JPMorgan Chase were up 47 percent to $4.8 billion. - Remarks by the President to the Chamber of Commerce — President Barack Obama (February 7, 2011 from U.S. Chamber of Commerce Headquarters, Washington, D.C.)

“So if I’ve got one message, my message is now is the time to invest in America. Now is the time to invest in America. (Applause.) Today, American companies have nearly $2 trillion sitting on their balance sheets. And I know that many of you have told me that you’re waiting for demand to rise before you get off the sidelines and expand, and that with millions of Americans out of work, demand has risen more slowly than any of us would like.” - Hoarding, not hiring – Corporations stockpile mountain of cash (April, 2010, ABCNews.com)

- U.S. firms build up record cash piles (June 2010, WSJ)

- Corporate America sitting on $1 trillion in cash ($2 trillion if you count short-term investments) (Dec. 2010 from JoshuaKennon.com)

…

What does that mean? It means that when the fear subsides, and companies are convinced that the world is all sunshine and roses, the turnaround can be rapid. Putting $1 trillion of cash to work in the economy, whether in the form of new product launches, capital expenditures, or even mergers and acquisitions paying off investors for their shares of companies and forcing them to find another use for their newly freed funds, can go a long way to solving the unemployment figures.

Addendum on 10/4/11 to potentially address a part of the other side of the table here:

- Economic Conditions Snapshot, September 2011: McKinsey Global Survey results |SEPTEMBER 2011

Our latest survey shows just how gloomy executives’ economic expectations are. A majority fear the eurozone will splinter; those in emerging markets are most hopeful.

Jobs! Jobs! Jobs!…..An innovative idea on how to do it now! – from Innovation Daily

Everyone is talking about the need to stimulate the depressed economy through job creation, but no one has developed a workable plan that can be implemented quickly. Innovation America, in co-operation with some bright industry and workforce development experts, respectfully submits a potential INNOVATIVE partnership that engages industry, academia and government (emphasis DSC).

The following white paper describes the “American Innovation Corps” a plan to create 200,000 to 400,000 jobs for unemployed or underemployed recent college graduates, America’s next generation of knowledge workers.

…

PROPOSED PROGRAM:

Innovation America proposes a plan to place qualified college graduates in full time jobs with growing small businesses utilizing existing mechanisms to establish and implement the following program. We would recommend that America’s community colleges, 4-year public and not-for-profit colleges and graduate universities administer the program at the local level with an estimated 1,000 colleges and universities participating to recruit candidates, link to local businesses and fiscally manage the program. At the national level, an agency with existing ties to institutions of higher education and an established funding mechanism in place will be engaged and given program oversight responsibilities. An example, which has been recently launched, is the Innovation Corps (I-Corps) program of the National Science Foundation. The goal of the I-Corps program is to connect NSF-funded scientific research with the technological, entrepreneurial and business communities to help create a stronger national ecosystem. The result is innovation to couple scientific discovery with technology development and societal needs.

Addendum on 9/8/11:

Over 80% of the respondents to the online survey run by Innovation America voted positively that the proposed American Innovation Corps Jobs program should receive serious consideration by the Obama Administration. There were over 450 unique viewers of the proposed plan and 110 of you voted for or against the plan as illustrated (as of 9/7 at 8:00pm):

Excerpt:

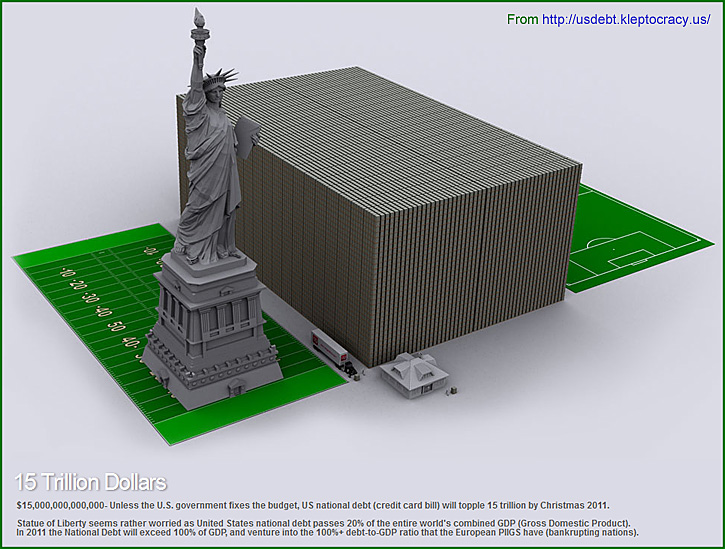

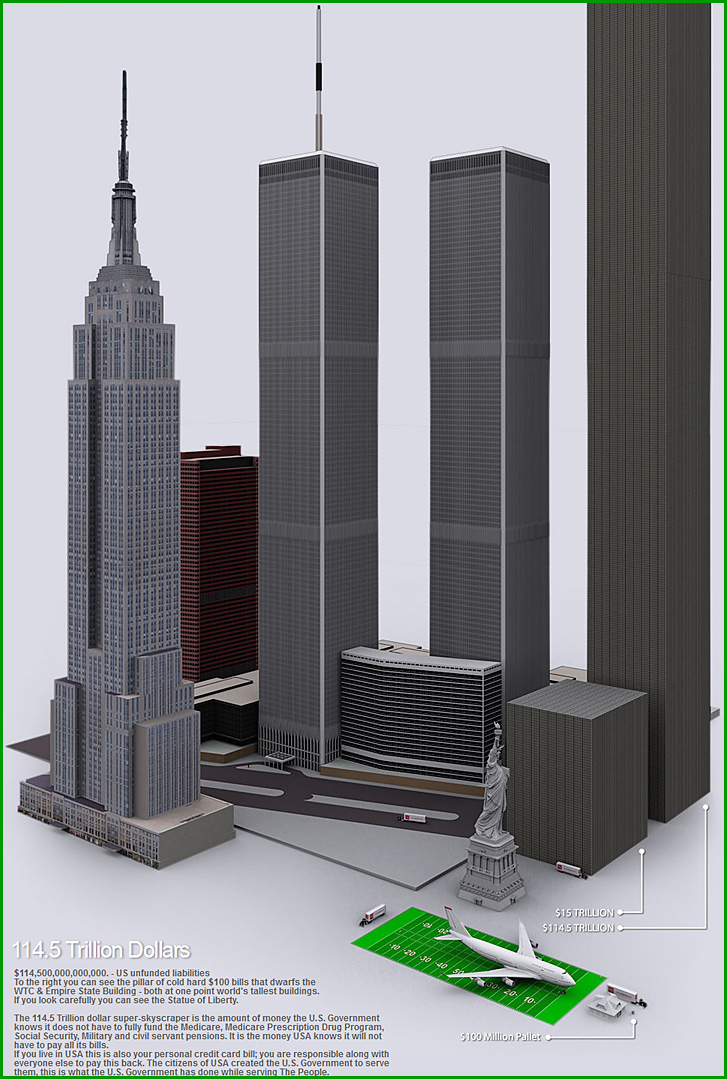

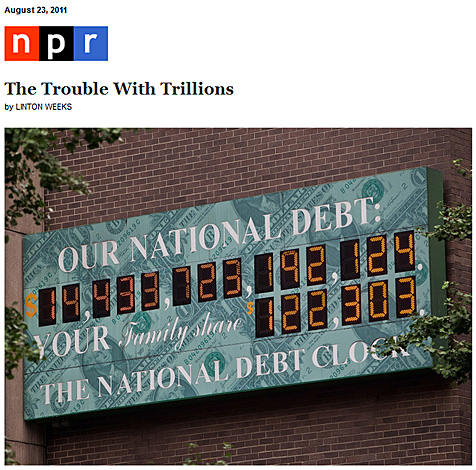

The news this summer is teeming with trillions. The national debt is more than $14 trillion. In a recent report, the credit rating agency Moody’s says the 1,600-plus U.S.-based companies it rates harbored some $1.2 trillion in cash at the end of 2010. The newly minted congressional supercommittee is charged with finding ways to pare the federal deficit by at least $1.2 trillion in the next decade.

…

Trillion. It’s the new black — tres chic, tres cher. The higher-water mark. If you’re not talking trillions, you’re talking chump change. All of a sudden we are tossing the term around like we understand it.

From DSC:

As always with my Learning Ecosystems blog, see the tags and categories that I referenced here as to how I think this item is especially relevant.

The high cost of low graduation rates — from air.org by Mark Schneider and Lu (Michelle) Yin

How much does dropping out of college really cost?

Brian Kuhn writes a solid posting at “Greed, Economy, and Education”

I remember posting a graphic/item on this very item back on an old website on 12/30/08:

A MUST READ: The End –from Portofolio.com, by Michael Lewis

NOTE: The language is not appropriate for kids.From DSC:

Greed is at the heart of this matter…and speaking of hearts, we Americans need to tend to our often cold and non-caring hearts, which also contributed greatly to the problems that we are now facing. It’s a very disturbing article; and it points out the critical need for all of us to be standing on solid moral ground. Don’t get me wrong, I know that I’m a sinner (and so is everyone else) and my sin is ever before me. But when you mess with other peoples’ lives, money, and futures…you need to have your feet on some solid ground and at least strive to do the right thing!It also points out that we Americans don’t often want to hear the truth until we have to hear the truth or until we need someone to point the finger at and blame for the issues we face. For example, how many politicians have been discarded in the past because they delivered some harsh, unpopular truth and plans of action? This same thing happened to some of the prophets of old who had to deliver some unpopular truth. Perhaps these struggles will be the 2×4 onside our collectives heads to get our attention and move towards caring about others.

Psalm 73

A psalm of Asaph.

1 Surely God is good to Israel,

to those who are pure in heart.

2 But as for me, my feet had almost slipped;

I had nearly lost my foothold.

3 For I envied the arrogant

when I saw the prosperity of the wicked.

4 They have no struggles;

their bodies are healthy and strong.[a]

5 They are free from common human burdens;

they are not plagued by human ills.

6 Therefore pride is their necklace;

they clothe themselves with violence.

7 From their callous hearts comes iniquity[b];

their evil imaginations have no limits.

8 They scoff, and speak with malice;

with arrogance they threaten oppression.

9 Their mouths lay claim to heaven,

and their tongues take possession of the earth.

10 Therefore their people turn to them

and drink up waters in abundance.[c]

11 They say, “How would God know?

Does the Most High know anything?”

12 This is what the wicked are like—

always free of care, they go on amassing wealth.

13 Surely in vain I have kept my heart pure

and have washed my hands in innocence.

14 All day long I have been afflicted,

and every morning brings new punishments.

15 If I had spoken out like that,

I would have betrayed your children.

16 When I tried to understand all this,

it troubled me deeply

17 [until] I entered the sanctuary of God;

then I understood their final destiny. (emphasis DSC)

18 Surely you place them on slippery ground;

you cast them down to ruin.

19 How suddenly are they destroyed,

completely swept away by terrors!

20 They are like a dream when one awakes;

when you arise, Lord,

you will despise them as fantasies.