From DSC:

I was originally going to write this blog posting back in late July, when I read the first paragraphs of a solid article by Laura Pappano at the New York Times entitled, “The Master’s as the New Bachelor’s.” At that time, I couldn’t help but think…“Houston we have a problem.”

(Disclosure: I completed my Master’s of Science in

Instructional Design for Online Learning in June 2011 from Capella University.)

Excerpt:

William Klein’s story may sound familiar to his fellow graduates. After earning his bachelor’s in history from the College at Brockport, he found himself living in his parents’ Buffalo home, working the same $7.25-an-hour waiter job he had in high school.

It wasn’t that there weren’t other jobs out there. It’s that they all seemed to want more education. Even tutoring at a for-profit learning center or leading tours at a historic site required a master’s. “It’s pretty apparent that with the degree I have right now, there are not too many jobs I would want to commit to,” Mr. Klein says.

Then, fast forward to today when I was further reminded to contact Houston Command Control Center (metaphorically speaking) when I read Jennifer Lee’s article in today’s New York Times entitled, “Generation Limbo: Waiting It Out“.

Excerpt (emphasis DSC):

“We did everything we were supposed to,” said Stephanie Morales, 23, who graduated from Dartmouth College in 2009 with hopes of working in the arts. Instead she ended up waiting tables at a Chart House restaurant in Weehawken, N.J., earning $2.17 an hour plus tips, to pay off her student loans. “What was the point of working so hard for 22 years if there was nothing out there?” said Ms. Morales, who is now a paralegal and plans on attending law school.

Some of Ms. Morales’s classmates have found themselves on welfare. “You don’t expect someone who just spent four years in Ivy League schools to be on food stamps,” said Ms. Morales, who estimates that a half-dozen of her friends are on the Supplemental Nutrition Assistance Program. A few are even helping younger graduates figure out how to apply. “We are passing on these traditions on how to work in the adult world as working poor,” Ms. Morales said.

…

The journey on the life path, for many, is essentially stalled.

The reasons that I say that we have a problem here in the world of higher education are probably already clear, but to further elaborate on them (with the lenses of my past experience):

- Why should I pay ~$55,000 a year — $54,763 for just the 2011-2012 academic year — to go to Northwestern University, only to find out that my $220,000+ investment doesn’t land me an excellent, top-rate job? Are we saying that a degree from NU’s College of Arts & Sciences (CAS as it was known in my day) is not enough of an investment to get a good job? Are we now saying that I need another degree before I can start paying off my ever-mounting debt? (i.e. that gorilla on my back that continues to gain weight and has implications for the types of jobs that I now have to go for, whether I like them or whether I am gifted for them or not)

- How convenient for corporate HR and hiring managers to be able to ask for the moon yet again — while often not lifting a finger to help these students/potential employees pay for that education! My experience was that corporations always wanted to have their new employees hit the ground running. But with a crowd of people applying for each open position these days, I would be very interested to see the data on:

- What % of today’s corporations are actively helping folks obtain the advanced degrees that they are requesting?

- What % of the time these corporations do this?

- What % of their employees do such corporations provide this type of assistance for?

- What % of the degree — or up to what $$ amount — do they pay for?

.

Perhaps it is all to easy and convenient — and good for shareholders — during tough economic times to place all of the burden on the backs of the students/future employees; perhaps there are few incentives for companies to change the way the game is played.

.

- Speaking of incentives…how convenient for higher education to go along with this trend as well. After all, who wouldn’t want to support an environment that contributes to continued enrollments?

So…that’s why I say, “Houston, we have a problem.”

- This type of phenomenon and economic environment seems to be stoking the growing dissatisfaction against the costs involved with obtaining a degree within higher education and the perceived/real return on such an investment.

- Though “times might have been good” these last few decades, such times may be coming to an end; change is in the air..

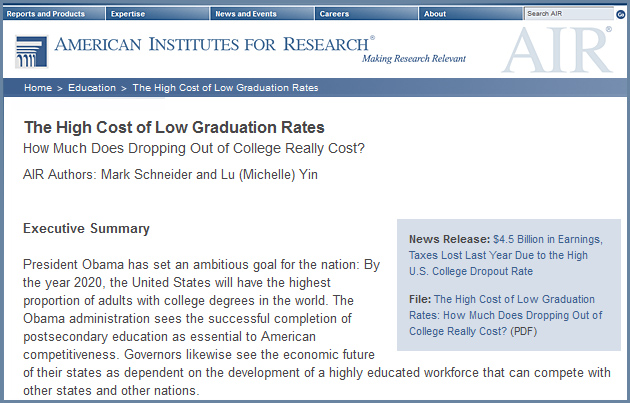

- How should we respond within higher education? Within the corporate world? How can we help more students/prospective employees obtain their college degrees?