More students defaulting on college loans — from the HechingerEd blog

Resources for finding out how long it takes to develop eLearning — from kaplaneduneering.com by Karl Kapp

From DSC:

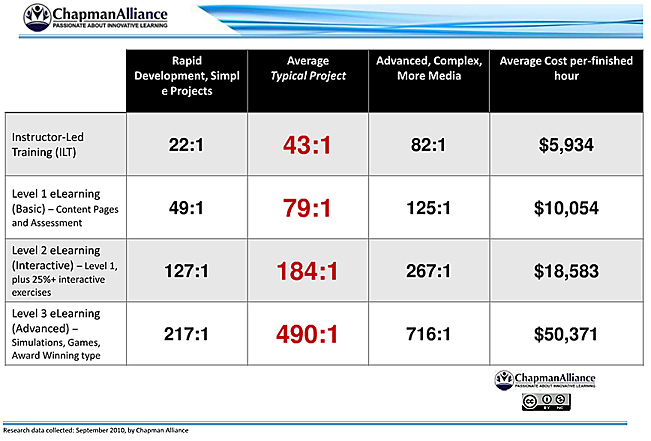

One resource mentioned was from the Chapman Alliance, from September 2010, of which these figures are from:

The impact of new business models for higher education on student financing

Financing Higher Education in Developing Countries

Think Tank | Bellagio Conference Centre | 8-12 August 2011

Sir John Daniel (Commonwealth of Learning)

&

Stamenka Uvali-Trumbi (UNESCO)

Excerpt:

The aim of this paper has been to suggest that in discussing student financing we need to look beyond the current standard model classroom teaching to the likely developments in learning systems over the next decade. These have the potential to cut costs dramatically and thereby lessen the challenge of student financing.

That is fortunate because nearly one-third of the world’s population (29.3%) is under 15. Today there are 165 million people enrolled in tertiary education.[2] Projections suggest that that participation will peak at 263 million in 2025.[3] Accommodating the additional 98 million students would require more than four major campus universities (30,000 students) to open every week for the next fifteen years unless alternative models emerge. (emphasis DSC)

Also see:

OER for beginners: An introduction to sharing learning resources openly in healthcare education

The Higher Education Academy (HEA) (www.heacademy.ac.uk) and the Joint information Systems Committee (JISC) (www.jisc.ac.uk) are working in partnership to develop the HEFCE-funded Open Educational Resources (OER) programme, supporting UK higher education institutions in sharing their teaching and learning resources freely online across the world.

The high cost of low graduation rates — from air.org by Mark Schneider and Lu (Michelle) Yin

How much does dropping out of college really cost?

For-profit college group sued as U.S. lays out wide fraud — from the New York Times by Tamar Lewin

Excerpt:

The Department of Justice and four states on Monday filed a multibillion-dollar fraud suit against the Education Management Corporation, the nation’s second-largest for-profit college company, charging that it was not eligible for the $11 billion in state and federal financial aid it had received from July 2003 through June 2011.

Debt to degree: A new way of measuring college success — from educationsector.org by Kevin Carey and Erin Dillon

Excerpt:

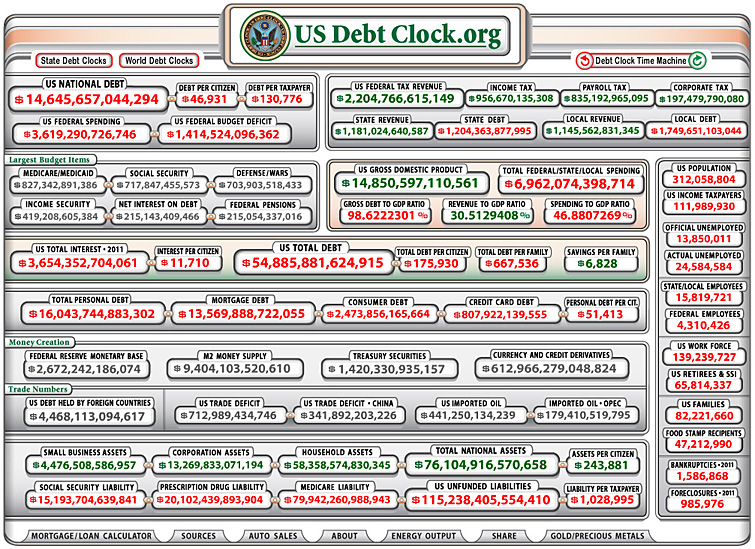

The American higher education system is plagued by two chronic problems: dropouts and debt. Barely half of the students who start college get a degree within six years, and graduation rates at less-selective colleges often hover at 25 percent or less. At the same time, student loan debt is at an all-time high, recently passing credit card debt in total volume.1 Loan default rates have risen sharply in recent years, consigning a growing number of students to years of financial misery. In combination, drop-outs and debt are a major threat to the nation’s ability to help students become productive, well-educated citizens.

Fixing Debt — from InsideHigherEd.com by Kevin Kiley

Excerpt:

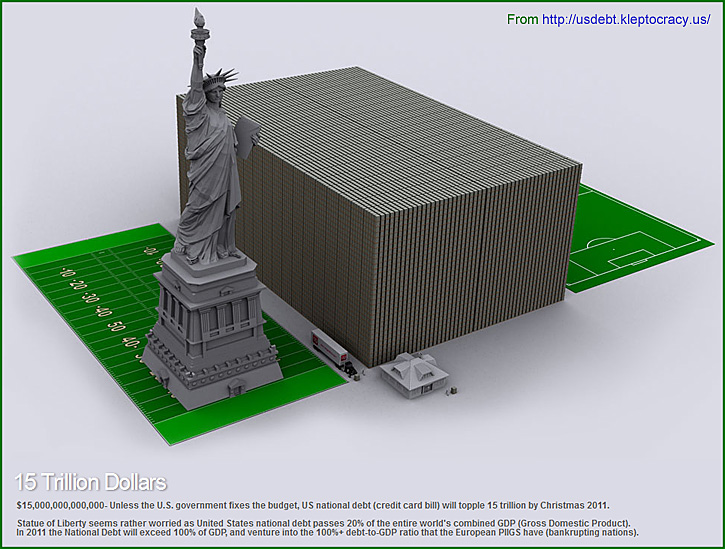

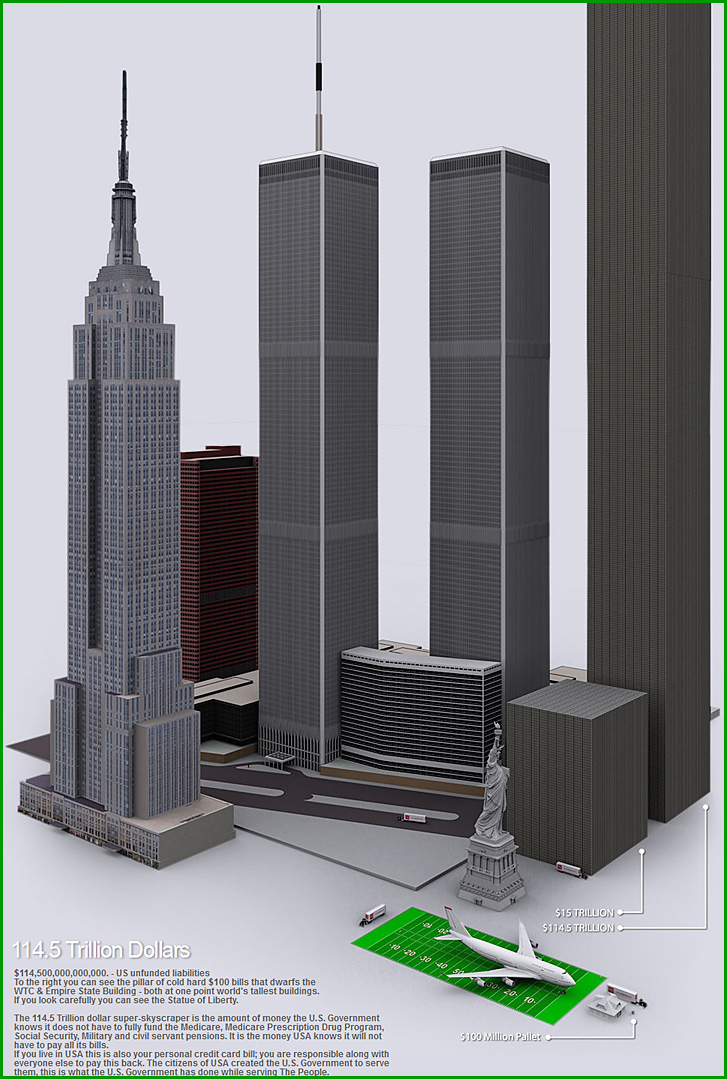

Colleges and universities don’t like uncertainty, and right now they’re facing a lot of it. No one knows how long it will take the economy to recover to pre-recession levels. The government’s sovereign credit rating, once ironclad, is under review for potential downgrade. And people aren’t even sure if, in less than a week’s time, the government will be able to pay its bills. Nobody knows what the national fiscal picture means for higher education. The current drama in Washington over the debt ceiling has only exacerbated several years’ worth of economic uncertainty that led colleges and universities to convert variable-rate debt — a potentially volatile form of borrowing in which the interest rate can change weekly depending on the market — to fixed-rate debt. They purchased the variable-rate debt in droves because of historically low interest rates; shifting to fixed-rate debt will come at a price. But doing so provides somewhat more stability, no matter what happens in Washington — even if the worst unfolds and the government defaults, one of several factors that could send variable rates soaring.