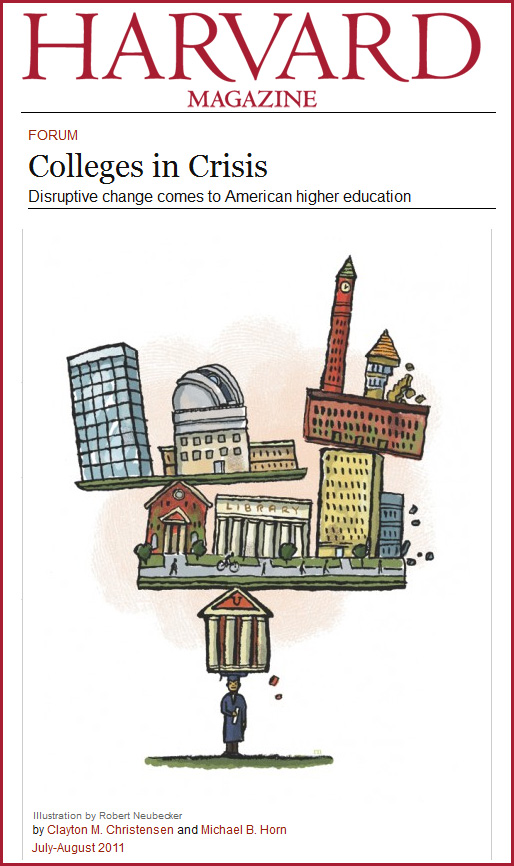

The impact of new business models for higher education on student financing

Financing Higher Education in Developing Countries

Think Tank | Bellagio Conference Centre | 8-12 August 2011

Sir John Daniel (Commonwealth of Learning)

&

Stamenka Uvali-Trumbi (UNESCO)

Excerpt:

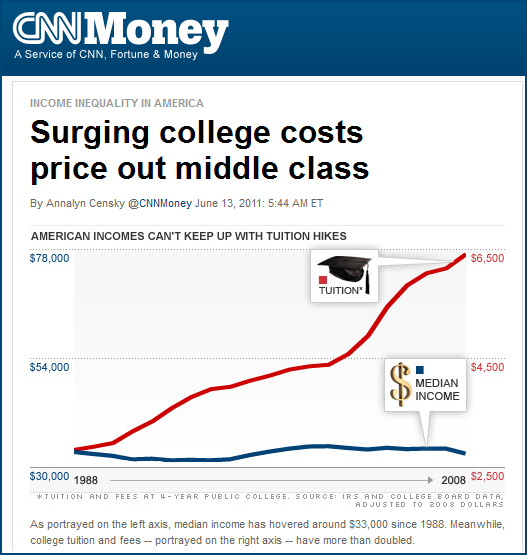

The aim of this paper has been to suggest that in discussing student financing we need to look beyond the current standard model classroom teaching to the likely developments in learning systems over the next decade. These have the potential to cut costs dramatically and thereby lessen the challenge of student financing.

That is fortunate because nearly one-third of the world’s population (29.3%) is under 15. Today there are 165 million people enrolled in tertiary education.[2] Projections suggest that that participation will peak at 263 million in 2025.[3] Accommodating the additional 98 million students would require more than four major campus universities (30,000 students) to open every week for the next fifteen years unless alternative models emerge. (emphasis DSC)

Also see:

OER for beginners: An introduction to sharing learning resources openly in healthcare education

The Higher Education Academy (HEA) (www.heacademy.ac.uk) and the Joint information Systems Committee (JISC) (www.jisc.ac.uk) are working in partnership to develop the HEFCE-funded Open Educational Resources (OER) programme, supporting UK higher education institutions in sharing their teaching and learning resources freely online across the world.