To End Student Debt, Tie Tuition to Post-Graduation Salaries — from wired.com by Austen Allred

Opinion: If colleges only get paid when their graduates do, they’re incentivized to provide a service that actually gets students hired.

Excerpt:

But unlike student loans, if regulated responsibly, ISAs power a risk-averse path to higher education. Responsible ISAs—which typically require zero upfront cost, repayment only if and when the graduate lands a job earning a sizable income, and an ethical repayment cap, such as $30,000 total—eliminate cost as a barrier to entry. But it’s the way that ISAs align the incentives of school and student that makes the model paradigm-changing.

…

The financial tool serves a diversity of students. People who can’t afford the cost of a traditional on-campus degree, or who don’t have access to federal- or state-based aid programs, can pursue a postsecondary education at no upfront cost. Additionally, those who are transitioning back into the workforce or changing careers can retrain in in-demand fields.

There’s no one-size-fits-all path to higher education. But Income Share Agreements prove that shouldering enormous risk doesn’t have to be a prerequisite for students. ISAs imagine a future in which graduates aren’t burdened by growing debt, and where opportunity is as evenly distributed as talent.

From DSC:

Can you hear and feel the culture clash that’s embedded here? I can.

On one side of the coin, there exists many faculty members, deans, provosts, and college/university presidents as well as other members of administration who maintain a more liberal arts perspective — that college is meant for learning and preparing students for many jobs…not just their first jobs.

On the other side of the coin are students who are paying ever increasing amounts of money to obtain their degrees. They want good jobs, and aren’t necessarily at school for the noble cause of learning. Many of these folks have different perspectives about what higher education is for…what it’s purpose is meant to be.

As the price of higher ed has increased, the former ways of viewing what a college education is supposed to be about — i.e., learning and a broad-based liberal arts type of education — are being increasingly shoved out the door. This is now by necessity I might add.

Along these lines, I can hear one of my former colleagues — an academic dean from years ago –adamantly insisting that higher education is not a business and that our students are not customers.

Since that time, it’s become very clear to me that higher education is most definitely a business. Not focusing on the multi-million dollar TV contracts or what many football coaches get paid…or not focusing on the revenue that research universities make on patents…let’s just focus on charging someone the price of a nice home for a 4-year degree. That alone makes it a business in my mind. The rising price of education has created customers.

(By the way, this development occurred on the watch of many of those same faculty members, provosts, presidents and other members of administration, etc. that claim a more noble goal of higher education.)

Students today can’t afford to attend school the way boomers did. As the article states:

When I went to college, nobody talked about student debt. Nobody talked about trade-offs. Everybody lived by one credo: Go to the best school you can, study the thing that you love, and it will work out on the other side. Frankly, for Boomers, that’s what happened. If you got a degree, you could expect to land a decent job with a decent salary. Even if you did accrue debt during college, payments were often manageable and short-lived.

That is certainly not the case anymore, as the article points out:

Bottom line:

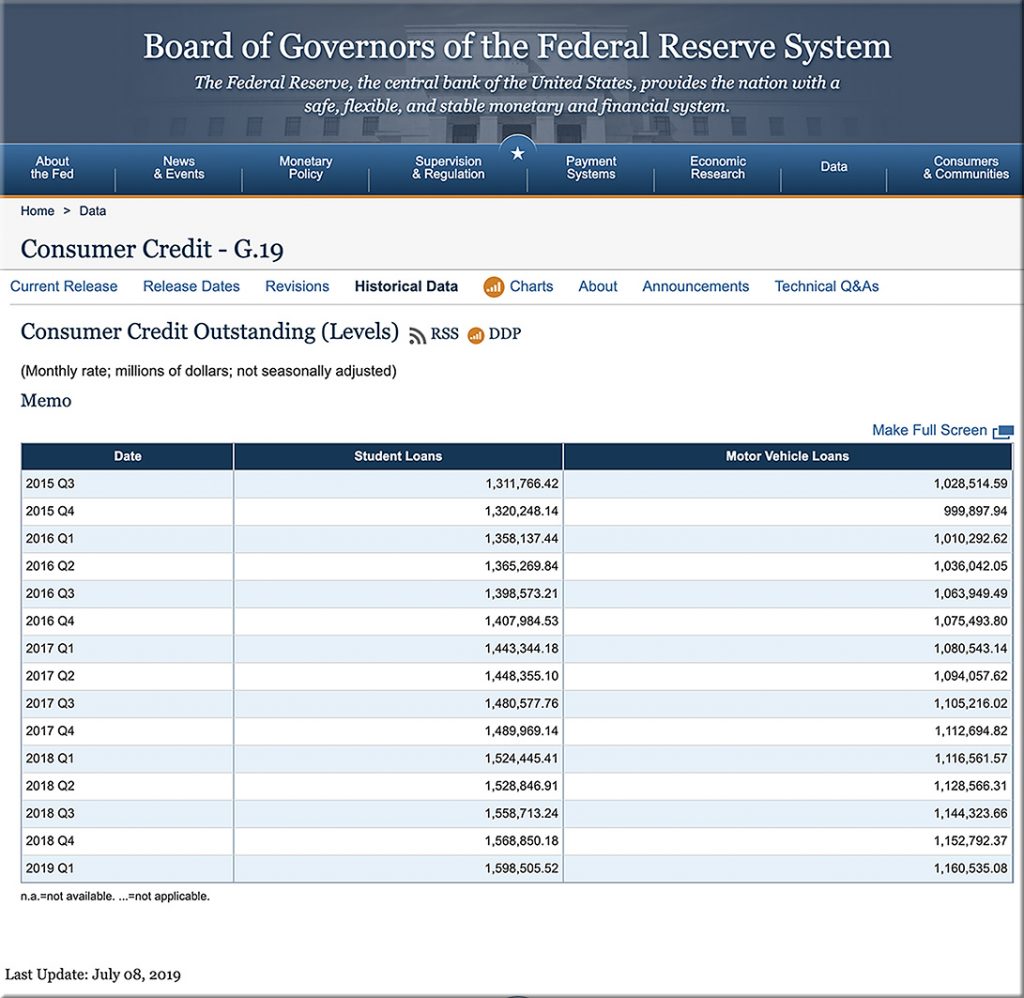

Change has to occur. It can’t keep going on like this. We are at the precipice of massive change. It has to change or we are in massive trouble as a nation. The ramifications of this kind of student debt last for decades!

This is why a next generation, online-based learning platform will be the answer for many people. Surely such a delivery method and learning experience will not work for everyone — as the face-to-face (F2f) experience is still excellent and preferred by many people. But the F2F experience is arguably becoming the Maserati….and increasingly out of reach…and it’s burying people in debt for decades to come.