Assignment #1:

Review the opinion/posting out at marketwatch.com entitled, “Opinion: How the stock market destroyed the middle class” by Rex Nutting and make a listing of the items you believe he is right on the mark on and another listing of items you believe he is mistaken about. Then answer the following questions:

- What data or other types of support can you find to backup your lists and perspectives?

- What data or other types of support does he bring to the table?

- What are the potential ramifications of this topic (on career development/livelihoods, policy, business practices, business ethics, families, society, innovation, other)?

- If companies aren’t investing in their employees as much, what advice would you give to existing employees within the corporate world? To your peers in your colleges and universities or to your peers within your MBA programs?

- Has the middle class decreased in size since the early 1980’s? What are some of the other factors involved here? Is this situation currently impacting families across the nation and if so, how?

Excerpt:

“The ‘buyback corporation’ is in large part responsible for a national economy characterized by income inequality, employment instability, and diminished innovative capacity,” wrote William Lazonick, an economics professor at the University of Massachusetts at Lowell in a new paper published by the Brookings Institution.

Lazonick argues that corporations — which once retained a sizable share of profits to reinvest (including investing in their workforce by paying them enough to get them to stay) — have adopted a “downsize-and-distribute” model.

It’s not just lefty academics and pundits who think buybacks are ruining America. Last week, the CEOs of America’s 500 biggest companies received a letter from Lawrence Fink, CEO of BlackRock BLK, +0.46% the largest asset manager in the world, saying exactly the same thing.

“The effects of the short-termist phenomenon are troubling both to those seeking to save for long-term goals such as retirement and for our broader economy,” Fink wrote, adding that favoring shareholders comes at the expense of investing in “innovation, skilled work forces or essential capital expenditures necessary to sustain long-term growth.”

Also see:

————–

Assignment #2:

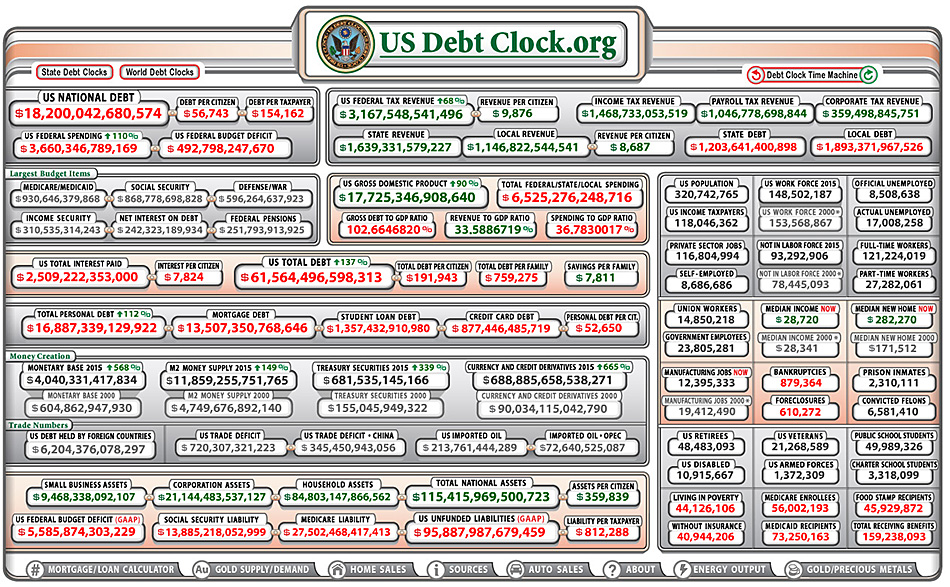

Review the current information out at usdebtclock.org and answer the following questions:

- What does the $18.2+ trillion (as of 4/24/15) U.S. National Debt affect?

- What level of debt is acceptable for a nation?

- What does that level of debt depend upon?

- Which of the pieces of information below have the most impact on future interest rates? Do we even know that or is that crystal balling it?

- Do the C-Suites at major companies look at this information? If so, what pieces of this information do they focus in on?

- Are there potential implications for inflation or items related to the financial stability of the banking systems throughout the globe?

- Are there any other ramifications of this information that you can think of?

- What might you focus in on if you were addressing the masses (i.e., all U.S. citizens)?

- Should politicians be aware of these #’s? If so, what might their concerns be for their constituents? For their local economies?

————–

Extra Credit Questions:

Now let’s bring it closer to home. Do you have some student loans that are contributing to the Student Loan Debt figure of $1.3+trillion (as of 4/24/15)? Do you see such loans impacting you in the future? If so, how?