What these firms all have in common are powerful digital platforms that provide the scale and scope to expand into new growth markets and geographies at speeds never before possible.

From DSC:

To me, the item below provides another example of the exponential pace of change that we are beginning to experience:

Corporate Longevity Forecast: The Pace of Creative Destruction is Accelerating — from innosight.com by Scott Anthony, S. Patrick Viguerie, Evan Schwartz and John Van Landeghem

Excerpt/Executive Summary:

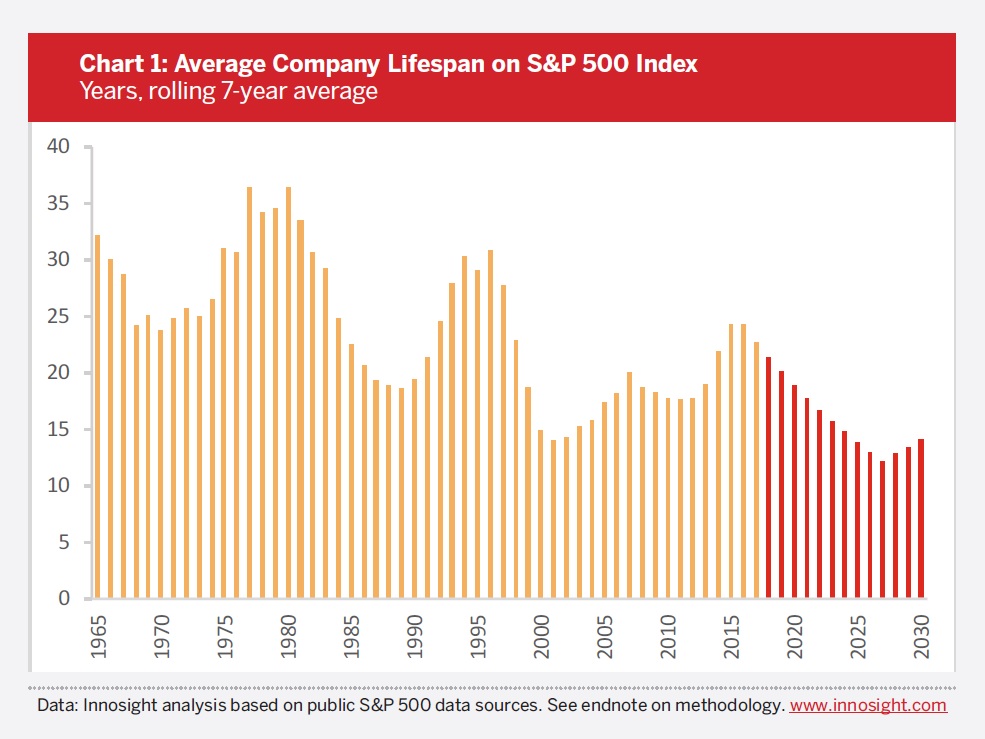

Few companies are immune to the forces of creative destruction. Our corporate longevity forecast of S&P 500 companies anticipates average tenure on the list growing shorter and shorter over the next decade.

Key insights include:

- The 33-year average tenure of companies on the S&P 500 in 1964 narrowed to 24 years by 2016 and is forecast to shrink to just 12 years by 2027 (Chart 1).

- Record private equity activity, a robust M&A market, and the growth of startups with billion-dollar valuations are leading indicators of future turbulence.

- A gale force warning to leaders: at the current churn rate, about half of S&P 500 companies will be replaced over the next ten years.

- Retailers were especially hit hard by disruptive forces, and there are strong signs of restructuring in financial services, healthcare, energy, travel, and real estate.

- The turbulence points to the need for companies to embrace a dual transformation, to focus on changing customer needs, and other strategic interventions.

…

Are Corporations Ready for Increased Turbulence?

Viewed as a larger picture, S&P 500 turnover serves as a barometer for marketplace change. Shrinking lifespans of companies on the list are in part driven by a complex combination of technology shifts and economic shocks, some of which are beyond the control of corporate leaders. But frequently, companies miss opportunities to adapt or take advantage of these changes. For example, they continue to apply existing business models to new markets, are slow to respond to disruptive competitors in low-profit segments, or fail to adequately envision and invest in new growth areas which often takes a decade or longer to pay off.

At the same time, we’ve seen the rise of other companies take their place on the list by creating new products, business models, and serving new customers. Some of the market forces driving these exits and entries include the mass disruption in retail, the rising dominance of digital technology platforms, the downward pressure on energy prices, strength in global travel and real estate, as well as the failure of stock buyback efforts to improve performance.