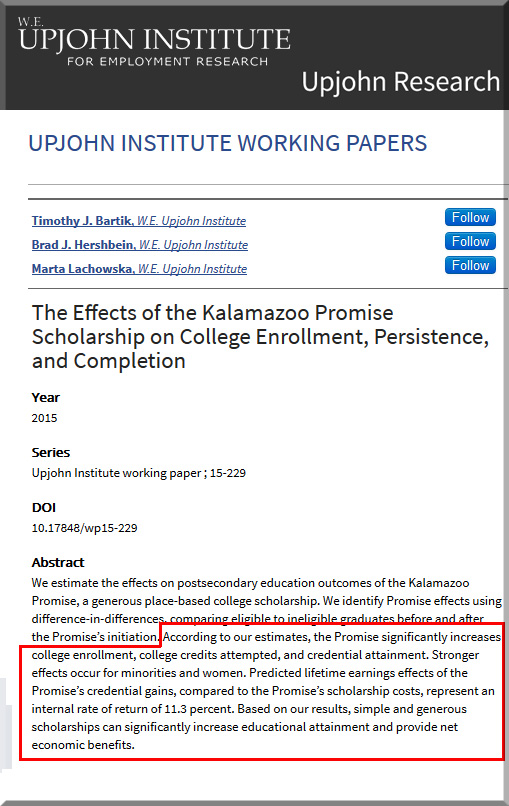

The Blockchain Revolution and Higher Education — from er.educause.edu by Don Tapscott and Alex Tapscott

The blockchain provides a rich, secure, and transparent platform on which to create a global network for higher learning. This Internet of value can help to reinvent higher education in a way the Internet of information alone could not.

Excerpt:

What will be the most important technology to change higher education? In our view, it’s not big data, the social web, MOOCs, virtual reality, or even artificial intelligence. We see these as components of something new, all enabled and transformed by an emerging technology called the blockchain.

OK, it’s not the most sonorous word ever, sounding more like a college football strategy than a transformative technology. Yet, sonorous or not, the blockchain represents nothing less than the second generation of the Internet, and it holds the potential to disrupt money, business, government, and yes, higher education.

The opportunities for innovators in higher education fall into four categories:

- Identity and Student Records: How we identify students; protect their privacy; measure, record, and credential their accomplishments; and keep these records secure

- New Pedagogy: How we customize teaching to each student and create new models of learning

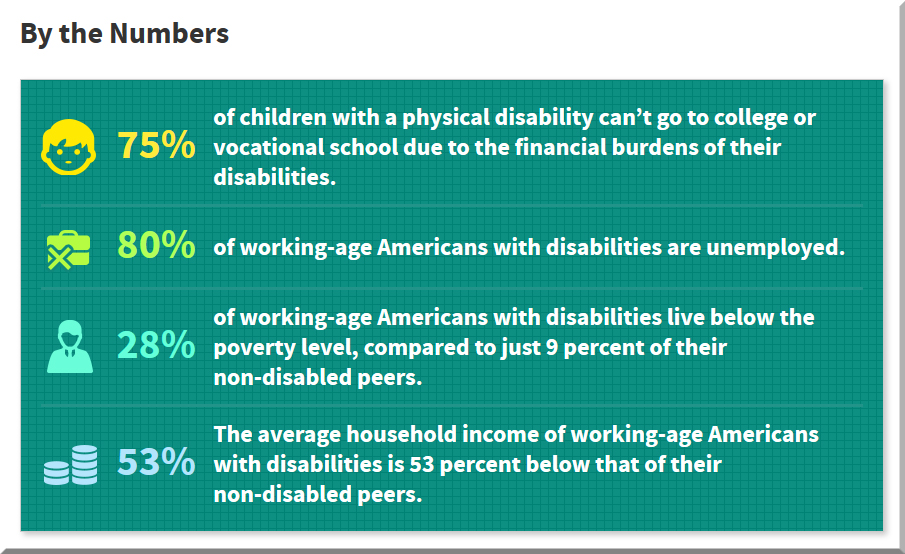

- Costs (Student Debt): How we value and fund education and reward students for the quality of their work

- The Meta-University: How we design entirely new models of higher education so that former MIT President Chuck Vest’s dream can become a reality1

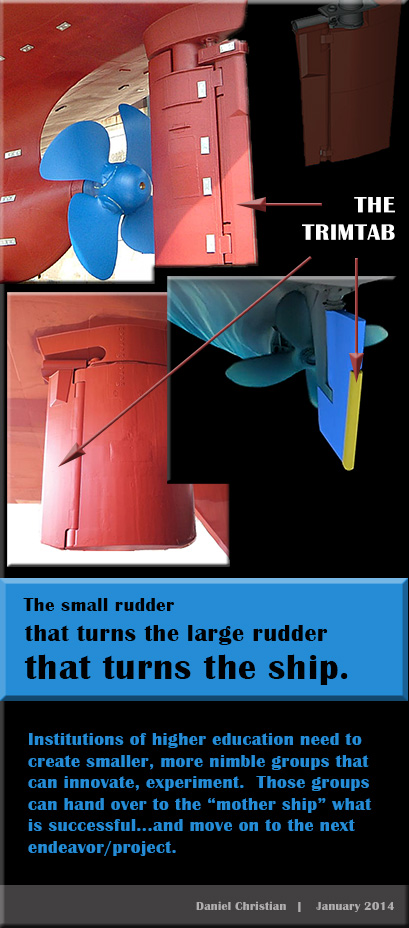

The blockchain may help us change the relationships among colleges and universities and, in turn, their relationship to society.

Let us explain.

What if there was an Internet of value — a global, distributed, highly secure platform, ledger, or database where we could store and exchange things of value and where we could trust each other without powerful intermediaries? That is the blockchain.

From DSC:

The quote…

In 2006, MIT President Emeritus Vest offered a tantalizing vision of what he called the meta-university. In the open-access movement, he saw “a transcendent, accessible, empowering, dynamic, communally constructed framework of open materials and platforms on which much of higher education worldwide can be constructed or enhanced.”

…made me wonder if this is where a vision that I’m tracking called Learning from the Living [Class] Room is heading. Also, along these lines, futurist Thomas Frey believes

“I’ve been predicting that by 2030 the largest company on the internet is going to be an education-based company that we haven’t heard of yet,” Frey, the senior futurist at the DaVinci Institute think tank, tells Business Insider. (source)

Blockchain could be a key piece of this vision.

![The Living [Class] Room -- by Daniel Christian -- July 2012 -- a second device used in conjunction with a Smart/Connected TV](http://danielschristian.com/learning-ecosystems/wp-content/uploads/2012/07/The-Living-Class-Room-Daniel-S-Christian-July-2012.jpg)