From DSC:

I’m not saying not to go there…but one has to be very careful when dealing with cryptocurrencies. As the items below show, you can mess up…big time.

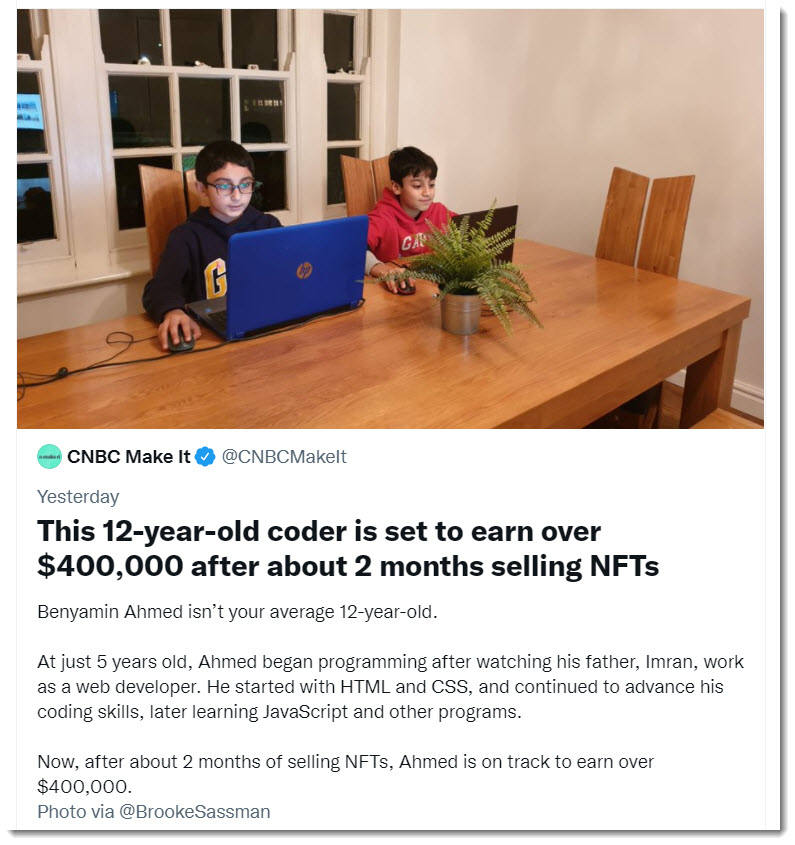

- A Man Accidentally Threw Out a Hard Drive Worth $357 Million in Bitcoin — from interestingengineering.com by Chris Young

And he’s been searching for it for a decade. - Crypto scammers stole almost $8 billion in 2021, up 81% from 2020 — from protocol.com by Benjamin Pimentel

More than a third of losses came from rug pulls, where developers rolled out crypto projects before vanishing with investor money - Frequently Asked Questions About Cryptocurrency — from 101blockchains.com by Georgia Weston

- Coin Worth $0.00004893 Highlights Crypto’s Wild Decimal Frontier — from bloomberg.com by Michael Regan

From DSC:

And that bit about the decimal point is key! I tried to locate an article that I recently read that described how one person lost hundreds of thousands of dollars because he misplaced the decimal in his asking price for a cryptocurrency. It was worth hundreds of thousands of dollars, but he said that his big thumbs got in the way. He mistyped the asking price and hit the Enter key before he recognized his mistake. He sold the cryptocurrency for a fraction of its real value. In that case, one would hope that the buyer would extend some grace and readjust the price. But that didn’t happen in this case. Ouch!

From DSC:

Again, I’m not saying that this area may not represent an enormous new, impactful, prosperous wave to ride. But I need to do a whole lot more learning before I feel comfortable jumping into this ocean.

That said when I read the quote below…I wondered:

DC: I wonder if that sentence could also read:

“Crypto needed a use case, and it found it in a next generation learning platform.”#cryptocurrency #Cryptos #cryptocurrencies #lifelonglearning #onlinelearning #learning #CMS #LMS #platform

— Daniel Christian (he/him/his) (@dchristian5) December 17, 2021