Facing the future: “Everything about our financial services experience will change.”

What will the bank of the future look like? — from weforum.org by Taavet Hinrikus (formerly…as Skype’s first employee, Taavet helped build a company that has changed hundreds of millions of lives…so he knows how to ride these “waves.”)

Excerpt:

Lionel Barber, the editor of the FT, summed it up at Davos: “Nobody wants to be in banking, everyone wants to be in FinTech”. FinTech — or financial technology — has reached the mainstream, but what does this mean for the banks?

The Fourth Industrial Revolution is taking hold in banking. The rise of FinTech came about over the last five years primarily as the result of five key developments:

- Loss of trust in the global financial crisis of 2008

- Higher expecations

- Rise of the Millennials

- The rise of the mobile Internet

- Regulation that truly looks after the rights of the consumer

…

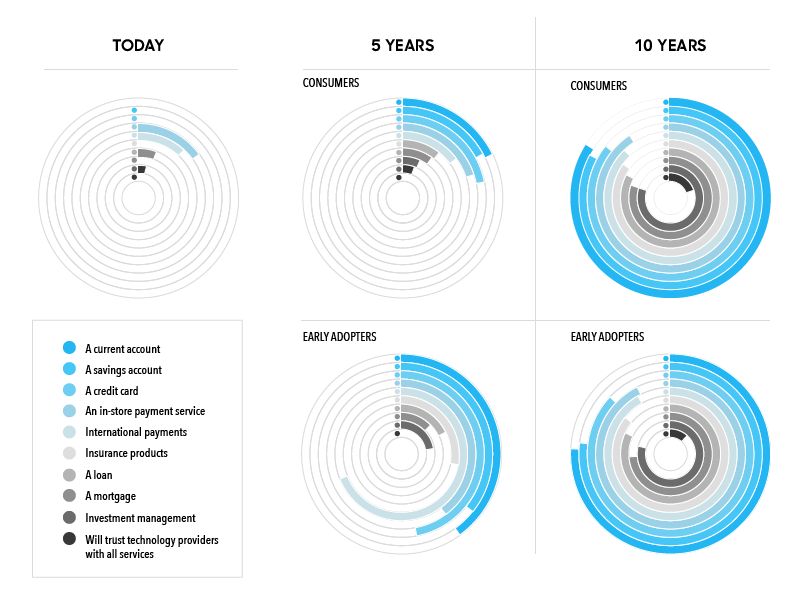

Looking ahead to ten years’ time, the picture changes even more dramatically: 20% of consumers anticipate they will trust technology providers with all their financial service across the board from credit cards to mortgages.