.

Also see:

My thanks to Academic Impressions for the resources/updates

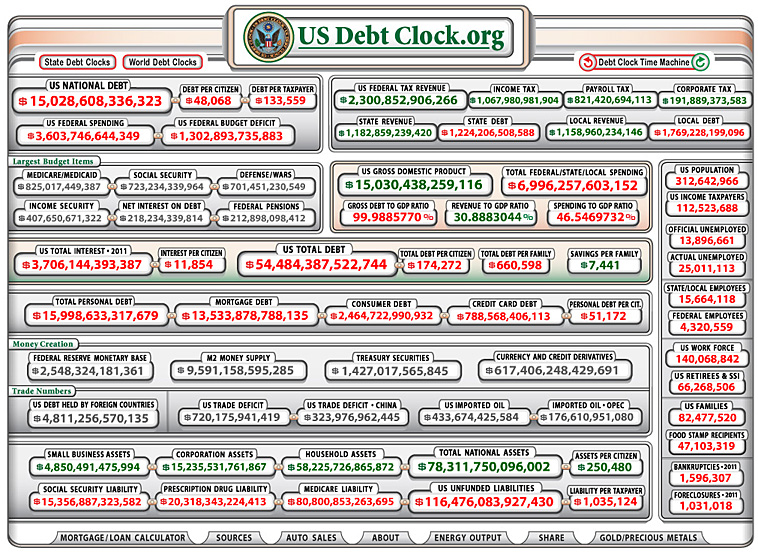

U.S. debt $417 billion below the debt ceiling — from CNN.com by Jeanne Sahadi

Excerpt:

The debt ceiling is currently set at $16.394 trillion. At the end of August, the amount of debt subject to that limit — which excludes certain types of debt — was $15.977 trillion, roughly $417 billion below the cap. Since the government typically borrows between $100 billion and $125 billion a month, that means it’s on track to hit the ceiling sometime in December. But the Treasury Department will likely be able to use “extraordinary measures” to keep the debt just below the legal limit for a couple of months.

Bottom line:

Congress will likely need to raise the ceiling in early 2013 or Treasury will risk defaulting on the country’s legal obligations by failing to pay all of its bills in full and on time.

From DSC:

At some point, if we don’t turn things around, the vast majority of our tax dollars will go to pay for interest on our debt…and. nothing. else.

Excerpt:

Is there anything to be done about the rising price of higher education? That was the question posed to John Hennessy, president of Stanford University, and Salman Khan, founder of Khan Academy, a nonprofit online-learning organization. They sat down with The Wall Street Journal’s Walt Mossberg to discuss how technology might be part of the solution.

Here are edited excerpts of their conversation.

Addendum on 6/7/12:

…and back from previous dates:

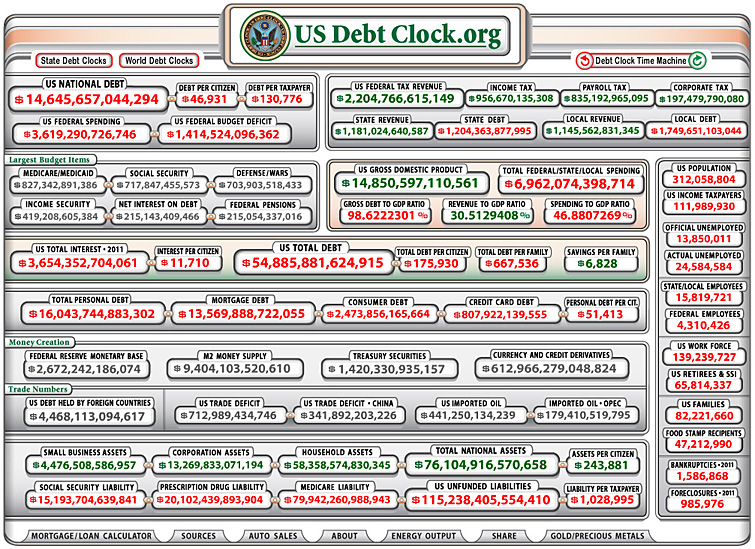

As of 11-20-11

As of 8-24-11

Also see:

Addendum on 5/7/12:

Excerpt:

All around the world, the pace of change in higher education is accelerating. In the face of continued increases in participation, demographic change and – in the west at least – profound fiscal crises, higher education institutions are increasingly being required to raise funds from students as opposed to relying on transfers from governments. Indeed, the pace of policy change is coming so quickly that it is difficult to keep track of all the relevant developments in different parts of the world.

In this, the second edition of Year in Review: Tuition Fees and Student Assistance, we outline the major changes related to higher education affordability around the world in 2011. In order to keep our sample manageable, we have kept our inquiries to a selection of 40 countries that collectively best represent the global situation:

The G-40 consists of: Argentina, Australia, Brazil, Canada, Chile, China, Colombia, Egypt, Finland, France, Germany, Hong Kong, India, Indonesia, Iran, Israel, Italy, Japan, Korea (Republic of), Malaysia, Mexico, the Netherlands, Nigeria, Pakistan, Philippines, Poland, Russian Federation, Saudi Arabia, Singapore, South Africa, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, Ukraine, United Kingdom, United States, Vietnam.

Marcucci, Pamela and Usher, Alex (2012). 2011 Year in Review:

Global Changes in Tuition Fee Policies and Student Financial Assistance.

Toronto: Higher Education Strategy Associates.

Below are the concluding paragraphs of Introducing Bennett Hypothesis 2.0 [by Andrew Gillen, Center for College Affordability and Productivity, with emphasis below from DSC)

Original Bennett Hypothesis + a couple refinements + Bowen’s Rule = Bennett Hypothesis 2.0.

The original Bennett Hypothesis held that increases in financial aid will lead to higher tuition, but the empirical evidence testing the hypothesis is inconclusive. The next generation of the concept, Bennett Hypothesis 2.0, adds three refinements.

1. All Aid is Not Created Equal

2. Selectivity, Tuition Caps, and Price Discrimination are Important

3. Don’t Ignore the Dynamic Story

These three refinements not only help explain the mixed empirical evidence, but also provide a better understanding of the relationship between financial aid and tuition. While the first two refinements weaken the link between the two (lessening our concern about Bennett Hypothesis 2.0), the third refinement strengthens the link, implying that we should almost always be concerned about financial aid leading to higher tuition.

Given the current structure of the higher education system, Bennett Hypothesis 2.0 implies that the government will always be fighting a losing battle to increase access to college or improve college affordability since “additional government [financial aid] funds keep providing revenues that, under the current incentive system, increase costs.”54 As higher financial aid pushes costs higher, it inevitably puts upward pressure on tuition. Higher tuition, of course, reduces college affordability, leading to calls for more financial aid, setting the vicious cycle in motion all over again.

Bennett Hypothesis 2.0 exacerbates rather than causes out of control spending by colleges, the ultimate cause of which is Bowen’s Rule. Nevertheless, that is no excuse for ill-designed financial aid programs to pour fuel the fire. As Bennett noted:

“Federal student aid policies do not cause college price inflation, but there is little doubt that they help make it possible.”55

Those words remain just as true today as they were a quarter century ago.

From DSC:

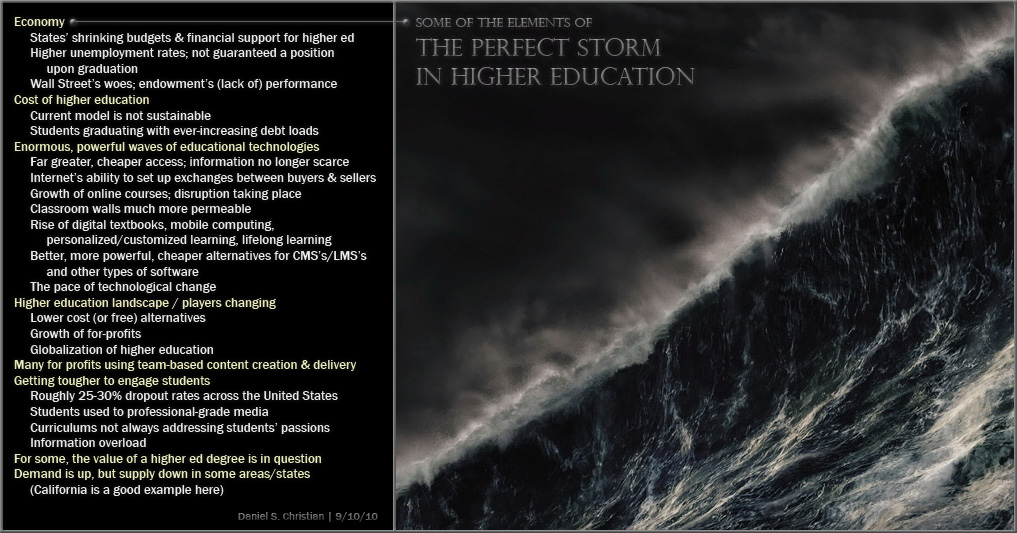

This report seems to show that the current system is only serving to expand the higher ed bubble even further; surely a pop will be heard in the future (if it hasn’t already at some individual colleges and universities). Such a financial aid system seems to be causing one of the elements of the perfect storm — the cost of higher ed — to mount its waves to an even higher level. (Keep in mind I created the image below in September 2010, but many of these forces are still with us today.)

Official calls for urgency on college costs— from the New York Times by Tamar Lewin

Excerpts:

As Occupy movement protests helped push spiraling college costs into the national spotlight, Education Secretary Arne Duncan urged higher-education officials Tuesday to “think more creatively — and with much greater urgency” about ways to contain costs and reduce student debt.

…

“Three in four Americans now say that college is too expensive for most people to afford,” Mr. Duncan said. “That belief is even stronger among young adults — three-fourths of whom believe that graduates today have more debt than they can manage.”

Also see:

Addendum later on 11/30/11:

.

“My chief message today is a sobering one,” said Secretary Duncan yesterday at the annual Federal Student Aid conference in Las Vegas, Nev. “I want to ask you, and the entire higher education community, to look ahead and start thinking more creatively—and with much greater urgency—about how to contain the spiraling costs of college and reduce the burden of student debt on our nation’s students.”

The impact of new business models for higher education on student financing

Financing Higher Education in Developing Countries

Think Tank | Bellagio Conference Centre | 8-12 August 2011

Sir John Daniel (Commonwealth of Learning)

&

Stamenka Uvali-Trumbi (UNESCO)

Excerpt:

The aim of this paper has been to suggest that in discussing student financing we need to look beyond the current standard model classroom teaching to the likely developments in learning systems over the next decade. These have the potential to cut costs dramatically and thereby lessen the challenge of student financing.

That is fortunate because nearly one-third of the world’s population (29.3%) is under 15. Today there are 165 million people enrolled in tertiary education.[2] Projections suggest that that participation will peak at 263 million in 2025.[3] Accommodating the additional 98 million students would require more than four major campus universities (30,000 students) to open every week for the next fifteen years unless alternative models emerge. (emphasis DSC)

Also see:

OER for beginners: An introduction to sharing learning resources openly in healthcare education

The Higher Education Academy (HEA) (www.heacademy.ac.uk) and the Joint information Systems Committee (JISC) (www.jisc.ac.uk) are working in partnership to develop the HEFCE-funded Open Educational Resources (OER) programme, supporting UK higher education institutions in sharing their teaching and learning resources freely online across the world.