Recording everything: Digital storage as an enabler of authoritarian governments — by John Villasenor, a nonresident senior fellow in Governance Studies and in the Center for Technology Innovation at Brookings. He is also professor of electrical engineering at the University of California, Los Angeles.

Excerpt (emphasis DSC):

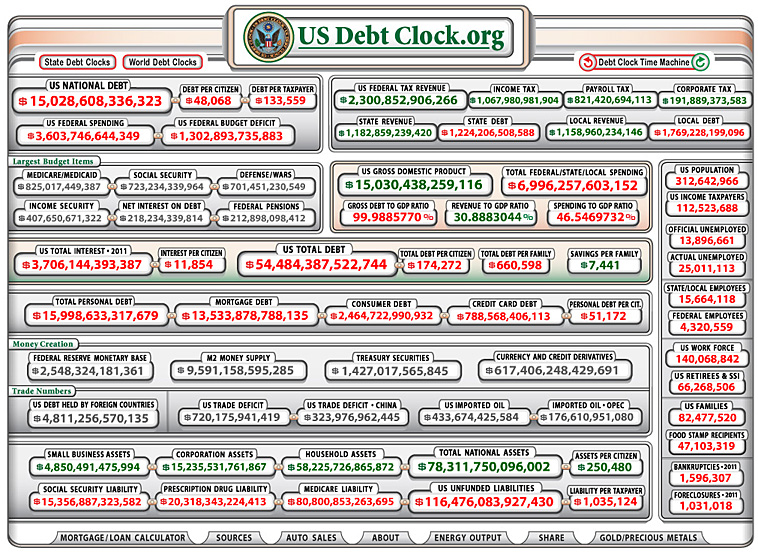

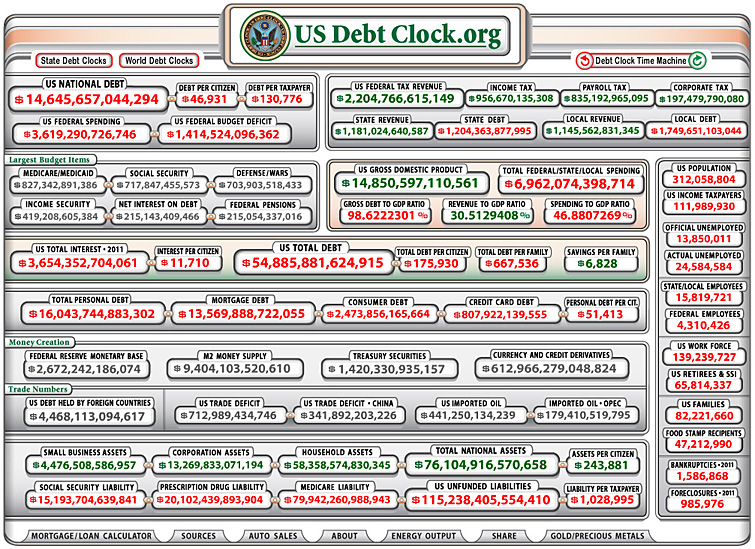

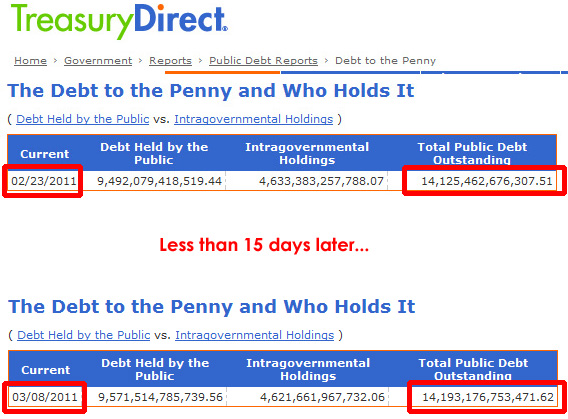

Within the next few years an important threshold will be crossed: For the first time ever, it will become technologically and financially feasible for authoritarian governments to record nearly everything that is said or done within their borders – every phone conversation, electronic message, social media interaction, the movements of nearly every person and vehicle, and video from every street corner. Governments with a history of using all of the tools at their disposal to track and monitor their citizens will undoubtedly make full use of this capability once it becomes available.

The Arab Spring of 2011, which saw regimes toppled by protesters organized via Twitter and Facebook, was heralded in much of the world as signifying a new era in which information technology alters the balance of power in favor of the repressed. However, within the world’s many remaining authoritarian regimes it was undoubtedly viewed very differently. For those governments, the Arab Spring likely underscored the perils of failing to exercise sufficient control of digital communications and highlighted the need to redouble their efforts to increase the monitoring of their citizenry.

…

Declining storage costs will soon make it practical for authoritarian governments to create permanent digital archives of the data gathered from pervasive surveillance systems. In countries where there is no meaningful public debate on privacy, there is no reason to expect governments not to fully exploit the ability to build databases containing every phone conversation, location data for almost every person and vehicle, and video from every public space in an entire country.

This will greatly expand the ability of repressive regimes to perform surveillance of opponents and to anticipate and react to unrest. In addition, the awareness among the populace of pervasive surveillance will reduce the willingness of people to engage in dissent.