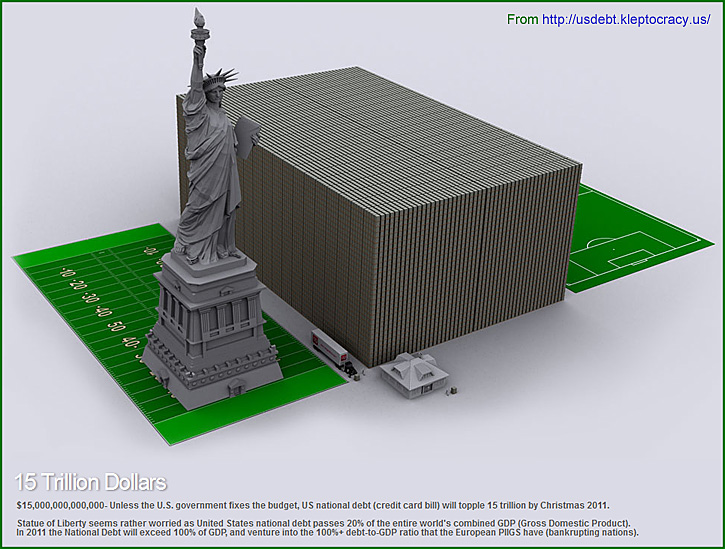

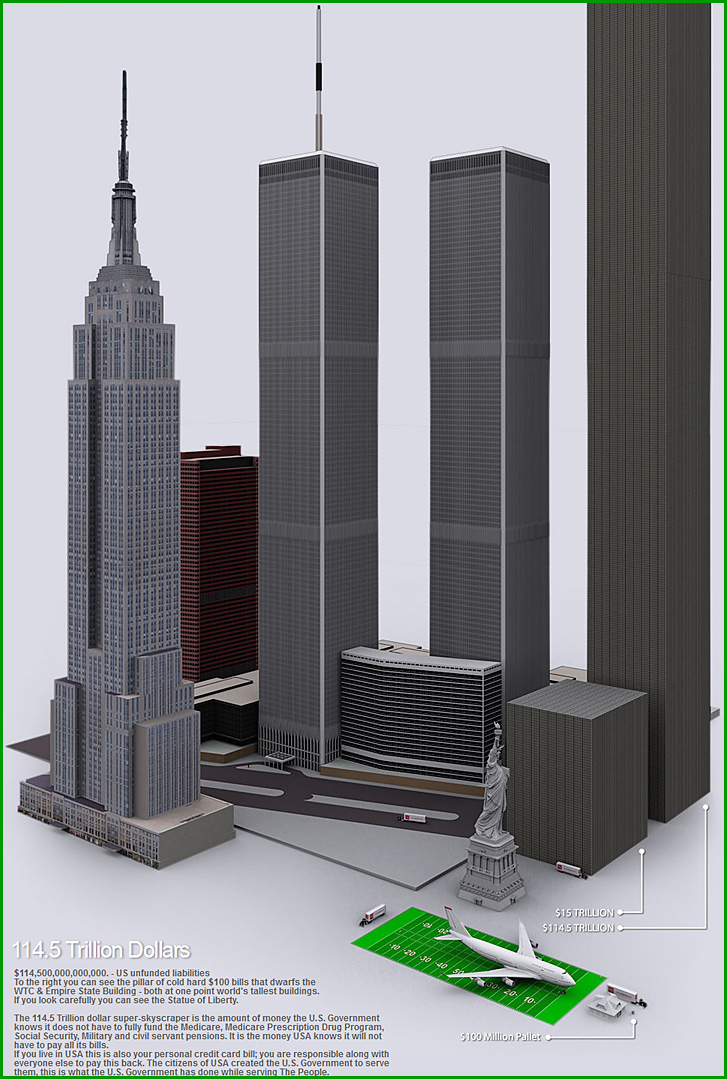

A visualization of the United States Debt — from usdebt.kleptocracy.us

From DSC:

Though this is the U.S. debt, the ramifications of this affect the entire globe. I believe my cousin, Mr. Stephen Gibson, is correct when he says that we may well be heading towards a “Global Reset.”

Also see:

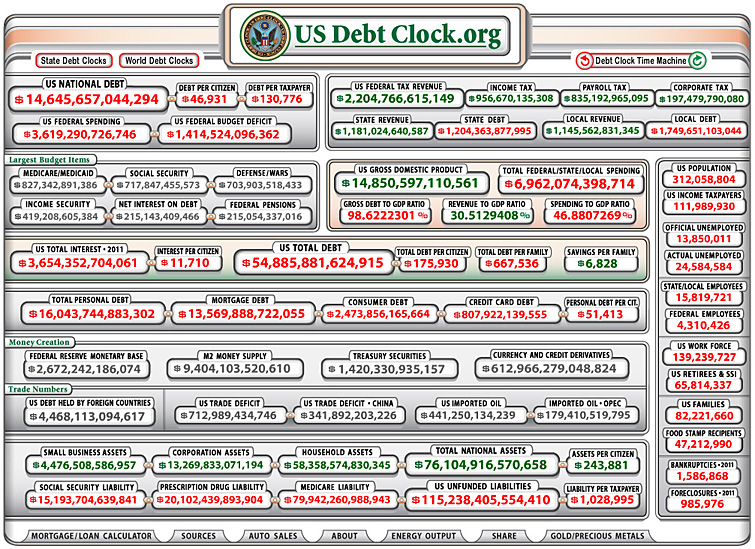

— as of 8/24/11 around noon

Addendums later on 8/24/11 from Academic Impressions:

- 10 consequences of state cuts to public higher education — from oncampus.mpr.org by Alex Friedrich

Just what are states pledging for higher ed these days?

- Fidelity® study finds significant shifts over 5-yr period in how families tackle rising college costs

Fifth Annual College Savings Indicator Study finds parents projected to meet only 16% of college costs, despite improved savings habits

BOSTON – Fidelity Investments®, a leader in helping families save for college, today announced the results of its fifth annual College Savings Indicator study, which found significant shifts in savings behavior from 2007 to 2011, with more families: 1) starting to save in the preschool years despite financial pressures, 2) seeking guidance and saving for college using a dedicated account, such as a tax-advantaged 529 college savings plan, and 3) making shared sacrifices to achieve their college savings goals.The study features the College Savings Indicator, a calculation of the percentage of projected college costs the typical American family is on track to cover, based on its current and expected savings. After four consecutive years of decline, the Indicator held steady to the prior year at 16 percent, down from 24 percent in 2007, when Fidelity first launched the study. While overall preparedness has declined, a larger percentage of parents — more than two-thirds (67 percent) — have begun saving for college costs, compared with 58 percent five years ago.

The US Debt is so upsetting! But what can we do about it? The problem is so complicated that I can’t begin to understand it. It’s sad that so many of us have to sit back and see what happens – and hope for the best…

Thanks Leslie for the comment here.

As I said to another cousin this morning, I’m not sure I have the answer…but one piece of the puzzle seems to be our hearts here in America. Our cold-heartedness and greed are one piece it seems to me. We’re struggling with — or already lost — a key piece of the foundation of our country — and that is, serving the LORD and each other. It’s everyone out for themselves too much I think. We push the LORD out of the public square and then wonder why Wall Street (and more) becomes a casino that uses other people’s retirement accounts as chips on the table. While that’s most likely far too simplistic of an answer, I do think it’s a key piece of the puzzle/downfall.

Peace,

Daniel