Education startup OnlineDegree.com makes the first year of college tuition-free — from forbes.com by Richard Vedder

Excerpt:

If you were told that an educational institution existed that would enable you to earn a year of college credit at zero financial cost and with minimal hassle –from a for-profit private entrepreneurial venture — you would no doubt be suspicious. I receive several pitches a week from individuals trying to promote all sorts of innovations, so I was especially dubious of this proposition – until I talked to Grant Aldrich, the fellow who helped initiate this project, and after reflecting a bit on modern internet-based businesses.

Hundreds of millions daily use at zero cost an immensely popular social media platform, Facebook. It provides much joy to user’s lives. Moreover, Facebook, Inc. has, of this writing, a market capitalization of $539.6 billion and its founder and CEO, Mark Zuckerberg, is at age 34, one of the richest people in the world. I suspect Grant Aldrich thinks that the Facebook model can be replicated successfully in higher education. Aldrich’s website (https://onlinedegree.com) will provide users with free, high-quality online college-level courses, financed through advertising, sponsorships, etc., much like Facebook and Google do.

The venture is brand new and modest in scope and is just now ready to launch its project.

He is bringing market-based capitalism to higher education without the crutch of government-subsidized student loans.

Yet Aldrich claims that he is not out to destroy traditional higher education, but rather to revitalize and support it. Students ultimately would go from his online courses into traditional schools, saving at least 25% of the cost through credit transfer, making traditional education significantly more affordable and viable.

The information below is from Grant Aldrich, Founder of OnlineDegree.com (emphasis via DSC)

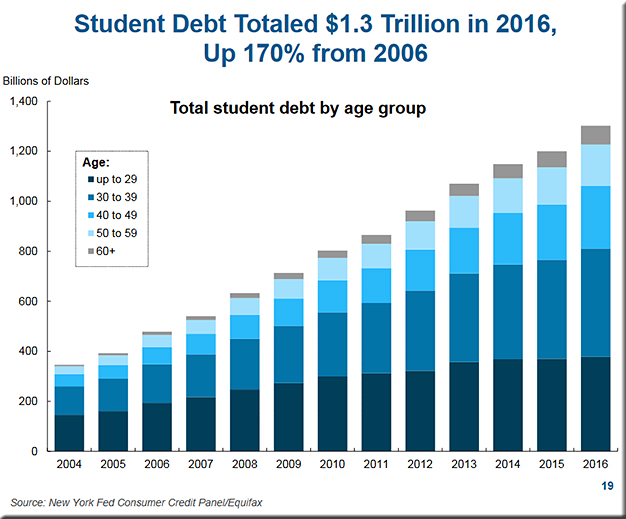

Rather than bypassing traditional universities like the MissionU’s or Coursera’s, we have a disruptive solution to innovate within higher ed to combat student debt and bring students back to a collegiate path.

Here’s the quick summary: At OnlineDegree.com, anyone could receive credit, up to their freshman year of college, completely tuition-free. All from home, on their own schedule, no pressure, and no applications.

We offer students free college-level courses and work with accredited universities across the country to award college credit for the courses students take. With many options to complete their entire freshman year equivalence, there are potential pathways to receive up to 44 units of recommended semester credit at over 1,400 colleges throughout the US…and growing.

By understanding the predicament that working adults have, it’s obvious that the current educational system hasn’t made it simple or easy enough for them to go back to school. They’re busy, can’t afford it, and have a lot of anxiety taking the first step. We’re changing that.

Further information is below.

Who Are We?

OnlineDegree.com is a team of startup veterans, leading academics and PhDs (from NYU, West Virginia University, Georgetown, etc). We’ve been working for over 2 years to make higher education more affordable and accessible for everyone. It’s been an incredible adventure to combat entrenched roadblocks and norms. More about us here:

How it Works

Students take as many college-level courses as they’d like on gen ed topics like Psychology, Robotics, Computer Programming, Marketing, History and many more…free. We’ve then worked with participating accredited universities across the country like Southern New Hampshire University, Excelsior College and others, so students can receive college credit for the courses they’ve taken. In addition, there are pathways to receive credit at over 1,400 schools in total throughout the US.

Our courses are:

- Online and Available 24/7 – No class schedules, no fixed times, and completely self-paced.

- Easy to Get Started- No applications, No entrance exams, and most importantly, No tuition.

- Interesting and Top Notch- Our professors are experts in their respective fields with PhDs and advanced degrees. The courses are incredibly interesting.

- Recommended for over 44 units of semester credit by the NCCRS

Why Is This So Disruptive?

Working adults now have a “bridge” to start their path back to school in 1 minute instead of 1 year in some cases…regardless of their finances or busy schedules. They can test drive different courses and subjects on their own schedule, be better prepared for college-level coursework at a university, and potentially receive college credits toward their degree. Given the common unfortunate student perception that applying directly to a community college or 4-year is intimidating, inflexible and/or costly, we’re more like “wading” into the pool rather than expecting everyone to jump in.

How Have We Made It Free?

We will always be 100% free to students…we’re not going to compromise on that. We’re exploring a marketplace for tutoring, Patreon, Kickstarter, university sponsorships/advertising, private grants, and many other avenues. We are bold enough to look outside of the traditional tuition paradigm to ensure we don’t exclude anyone from participating. There are all kinds of ways to keep the lights on without charging students or sacrificing educational quality.

Why Now?

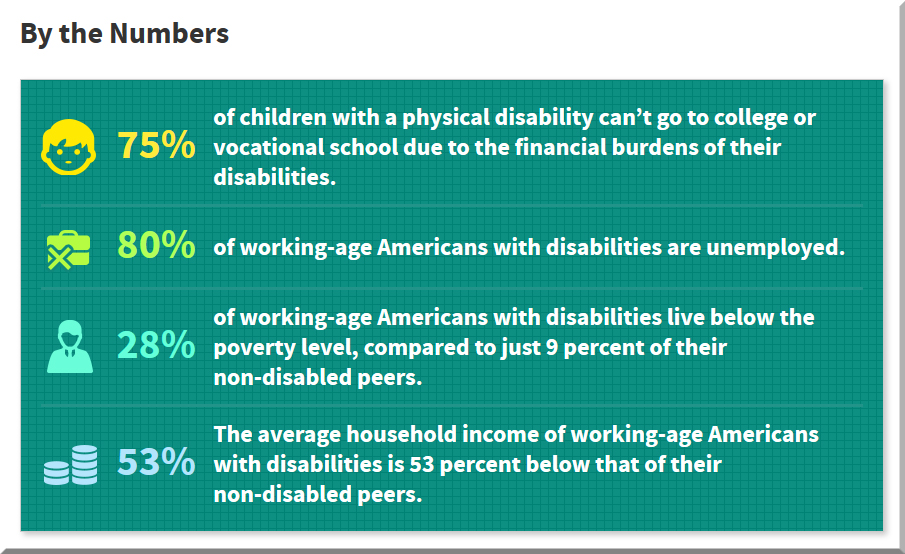

Despite overwhelming demand to go back to school in the face of eroding manufacturing jobs, robot automation, and a quickly modernizing economy, millions of working adults are still not going back to school at a traditional university. The key is to understand the predicaments of the working adult: accessibility and affordability. Other marketplace offers that circumvent higher education have become increasingly popular. We’re solving this by removing all of the barriers to enable that first critical step in starting back towards a traditional university.

Also see:

![The Living [Class] Room -- by Daniel Christian -- July 2012 -- a second device used in conjunction with a Smart/Connected TV](http://danielschristian.com/learning-ecosystems/wp-content/uploads/2012/07/The-Living-Class-Room-Daniel-S-Christian-July-2012.jpg)