From DSC:

I couldn’t help but reflect again on the state of our hearts here in the United States when I read Greg Smith’s Op-Ed in the New York Times entitled, “Why I Am Leaving Goldman Sachs”. It’s a depressing accounting of the rampant greed on Wall Street, with a disregard for deeper qualities and a true attention to meeting a customer’s/client’s needs and goals. It speaks to employees not giving a damn about clients, but only looking to make as much money as possible. (It’s fine to make a living, but how about sincerely trying to make a contribution to society at the same time?)

Some excerpts from Smith’s article:

And I can honestly say that the environment now is as toxic and destructive as I have ever seen it.

To put the problem in the simplest terms, the interests of the client continue to be sidelined in the way the firm operates and thinks about making money. Goldman Sachs is one of the world’s largest and most important investment banks and it is too integral to global finance to continue to act this way. The firm has veered so far from the place I joined right out of college that I can no longer in good conscience say that I identify with what it stands for.

…

What are three quick ways to become a leader? a) Execute on the firm’s “axes,” which is Goldman-speak for persuading your clients to invest in the stocks or other products that we are trying to get rid of because they are not seen as having a lot of potential profit. b) “Hunt Elephants.” In English: get your clients — some of whom are sophisticated, and some of whom aren’t — to trade whatever will bring the biggest profit to Goldman. Call me old-fashioned, but I don’t like selling my clients a product that is wrong for them. c) Find yourself sitting in a seat where your job is to trade any illiquid, opaque product with a three-letter acronym.

…

I attend derivatives sales meetings where not one single minute is spent asking questions about how we can help clients. It’s purely about how we can make the most possible money off of them. If you were an alien from Mars and sat in on one of these meetings, you would believe that a client’s success or progress was not part of the thought process at all.

From DSC:

I don’t know this man and I’m sure Goldman Sachs will try to discredit him; and yes, he was part of that culture and made a serious living off of it for years.

However, my focus is not on Greg Smith but upon the type of culture he spoke of; such a culture is not only bad for relationships — and ultimately for souls — but regardless of what you believe in terms of faith-based items, it’s simply bad business and it doesn’t benefit our society. In fact, it destroys it and it’s a significant contributing factor to the anger that continues to mount in the Occupy Wall Street phenomenon that is sweeping the nation.

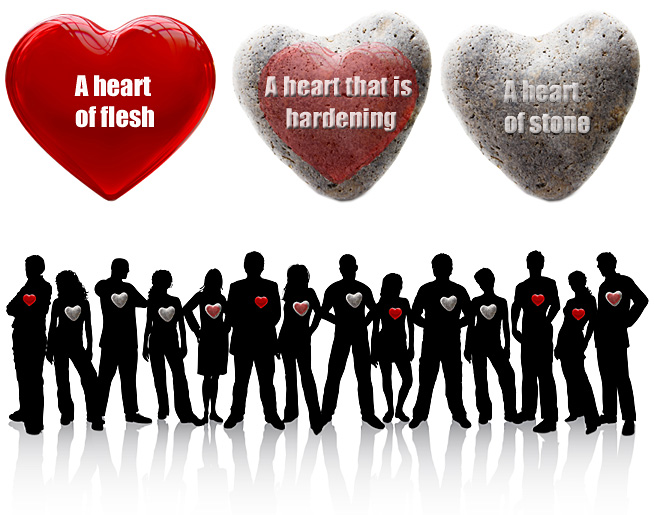

Some relevant graphics come to my mind:

.

.

Addendum on 3/21/12:

- This CEO should be ashamed of himself — from fool.com by Sean Williams

Excerpt:

CEO gets 44% pay raise while “Pfizer is in the midst of a multiyear cost-cutting campaign instituted in 2005 that includes eliminating a grand total of 55,400 jobs. That’s not a misprint — that’s 55,400 jobs gone, eliminated, axed! Pfizer announced the final phase of those jobs cuts recently, which will target 16,300 jobs and save the company a purported $1 billion in 2012. I have to wonder, how out of touch with reality do you have to be to give yourself a 44% raise as you are in the process of eliminating 16,300 jobs?”