From DSC:

Readers of this blog will know that I am pro-technology — at least in most areas. However, as our hearts can sometimes become hardened and our feet can sometimes find themselves on slippery ethical ground, we really need hearts, minds, and consciences that prompt us to care about other people — and to do the right thing as a result of that perspective.

Example articles that brought this to my mind recently include:

7 sinister technologies from Orwell’s 1984 that are still a threat — from dvice.com by Hal Rappaport

Excerpt (emphasis DSC):

Technology is a wonderful thing, but in the words of Spider-Man’s Uncle Ben, “With great power, comes great responsibility.” If we are not careful, the technology we know and love could be used against us, even subtly. In the year 1984, Apple thought IBM was the bringer of “Big Brother.” In reality, the technology of today better resembles George Orwell’s dystopian vision than a 1980s era PC.

Every day we are in the process of becoming a more connected society. With social networks, cloud computing and even more specific, less-thought-about tech such as Internet-connected home surveillance systems, we may find ourselves in a delicate balance of trust and paranoia.

…

While we are grateful that we don’t live in a world as bleak as Orwell’s Oceana, it’s clear that the technology now exists to make his world possible if we let it. Keeping our paranoia in check, we should all be mindful of our technology and how it’s used. Security is a good thing and so is saving money, but consider how much of each your personal freedom is worth.

Wiping away your Siri “fingerprint” — from technologyreview.com by David Talbot

Your voice can be a biometric identifier, like your fingerprint. Does Apple really have to store it on its own servers?

Excerpt:

“What I’ve discovered through building and running very targeted online ad campaigns using this data is that users respond favorably to ads that are more targeted, but only if the ads don’t make it clear that I’m targeting sensitive information about them,” he said. “What’s most interesting, and what I’m learning, are which attributes are considered too creepy, and which ones are acceptable.”

“Google Now” knows more about you than your family does – are you OK with that? — from readwriteweb.com by Mark Hachman

Excerpt (emphasis DSC):

Google Now aggregates the information Google already collects about you on a daily basis: accessing your email, your calendar, your contacts, your text messages, your location, your shopping habits, your payment history, as well as your choices in music, movies and books. It can even scan your photos and automatically identify them based on their subject, not just the file name (in the Google I/O demo, Google Now correctly found a picture of the Great Pyramid). About the only aspect of your online life that Google hasn’t apparently assimilated yet is your opinions expressed on Google+. But that’s undoubtedly coming.

Social network privacy settings compared — from techhive.com by Nick Mediati

Excerpt (emphasis DSC):

It should go without saying that protecting your privacy online is kind of a big deal. While people are generally good at not giving out their personal information to just any website that asks for it, those same people can be found filling their Facebook accounts with everything from their birthday to where they live and work. Putting this sensitive information onto a social network not only leaves your data exposed to third-parties (advertisers and so forth), but also to anyone who happens across your profile.

Facebook, Google+, and Twitter all have settings that let you tweak what others can see on your profile—but navigating them can be a bit of a mess. Not all social networks give you complete control over your privacy online, so here’s a quick overview of what Facebook, Google+, and Twitter allow you to do.

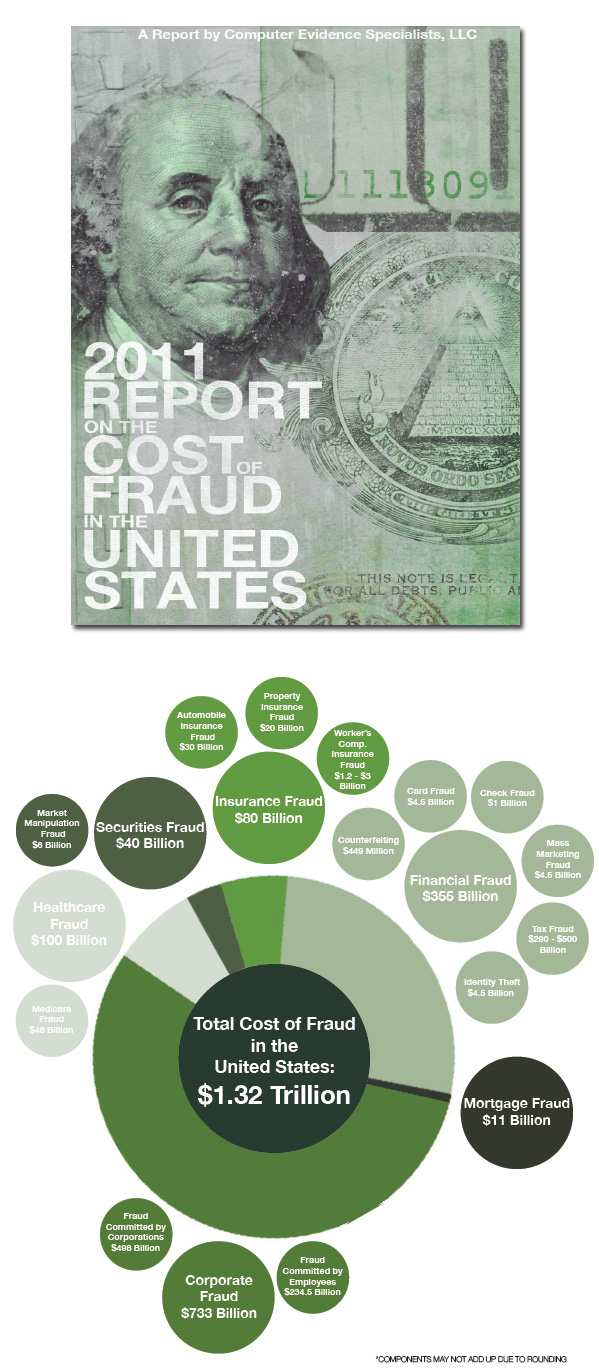

U.S. companies lost at least $13 billion to espionage last year — from ieee.org by Robert Charette

Google Glass & Now: Utopia or Dystopia? — from extremetech.com by Sebastian Anthony

Excerpt (emphasis DSC):

If you didn’t watch the Google I/O keynote presented by Vic Gundotra, Hugo Barra, and Sergey Brin, let me quickly bring you up to speed. Google Now is an Android app that uses your location, behavior history, and search history to display “just the right information at just the right time.” For example, if you regularly search for a certain sports team, Now will show you a card with the latest scores for that team. When Now predicts or detects that you’re leaving home in the morning, it will display a card with any relevant traffic information. If you have a lunch meeting in your Google Calendar, Now will show you the route you need to take to get there — and when you need to leave to get there on time. If you search Google for an airline flight, Now will show a card with the flight details (and any delays).

Big e-reader is watching you — from PaidContent.org by Laura Hazard Owen

Legal discovery: The billboard is imaginary, but the trend is real.

Trial lawyers are ramping up lawsuits over online privacy breaches.

Flickr Creative Commons | AdamL212 and istock/stocknroll

Addendums

On 7/6/12:

- Your e-book is reading you — WSJ.com by Alexandra Alter

Digital-book publishers and retailers now know more about their readers than ever before. How that’s changing the experience of reading.

On 7/16/12:

On 7/23/12: