Federal Reserve Bank of New York: Press Briefing on Household Debt, with Focus on Student Debt — with thanks to Mr. Bryan Alexander for his post on this

Excerpts:

Student Debt Overview

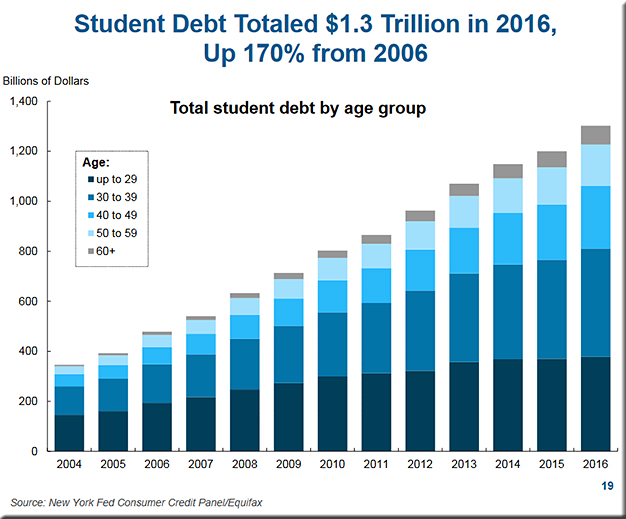

- Student debt was $1.3 trillion at the end of 2016, an increase of about 170% from 2006.

- Aggregate student debt is increasing because:

- More students are taking out loans

- Loans are for larger amounts

- Repayment rates have slowed down

- About 5% of the borrowers have more than $100,000 debt in 2016, but they account for about 30% of the total debt.

- Recent graduates with student loans leave school with about $34,000, up nearly 70% from 10 years ago.

- While the total level of household debt has nearly returned to the 2008 peak, debt types and borrower profiles have changed.

- Debt growth is now driven by non-housing sectors, and debt is held by older, more creditworthy borrowers.

- Student debt has expanded significantly because of higher levels of borrowing and slower rates of repayment.

- Student debt defaults peaked with the 2011 cohort and have improved somewhat since. However, payment progress has declined.

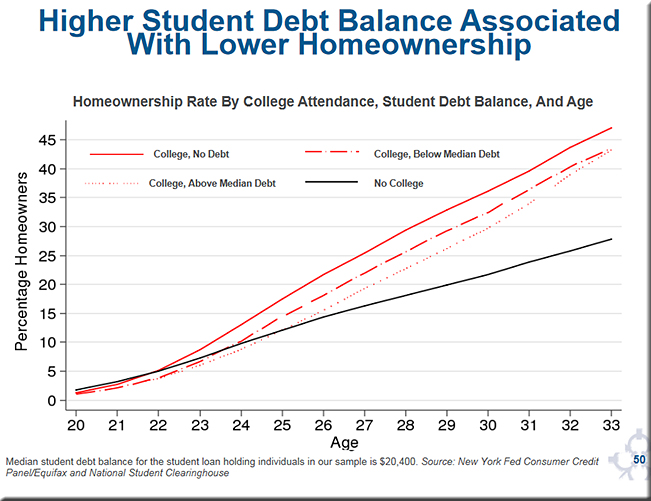

- College attendance is associated with significantly higher homeownership rates regardless of debt status. Yet, student debt appears to dampen homeownership rates among those with the same level of education.

- College attendance appears to mitigate the impact of economic background on homeownership rates.

Also see:

- An update on the staggering mass of student loan debt — from Bryan Alexander who links to the article immediately below

- A new look at the lasting consequences of student debt — from npr.org by Anya Kamenetz