From DSC:

As student debt increases, one of the things we forget is that graduating students will have to work on paying off their debt and, as a result, may need to postpone not just marriage and/or buying a house, but also in saving for their futures. That is, they may not be able to put money into any IRA’s, or additional funds into their 401k’s, or into other savings vehicles. This has enormous consequences for these graduates — and it has to do with the time value of money and compound interest.

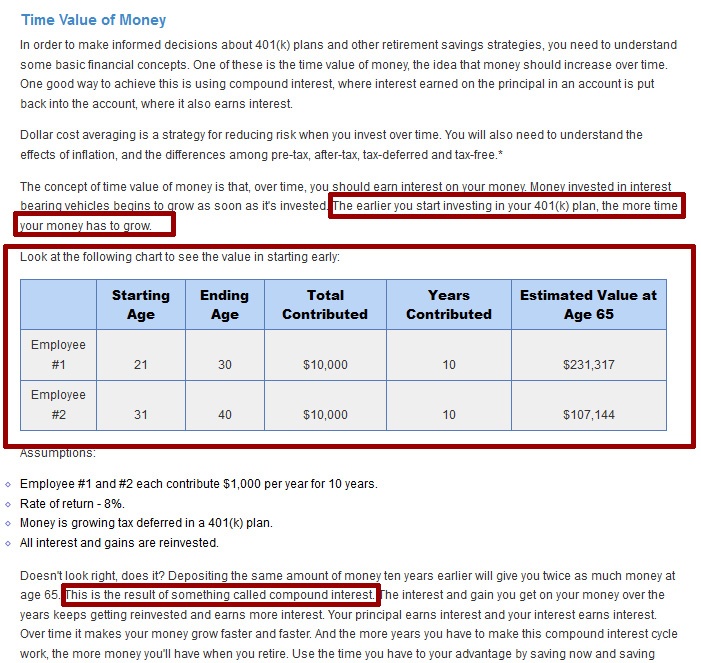

Consider the following comparison of two people — one investing between the ages of 21 and 30, and the other person who invests between the ages of 31 and 40. Look at the difference time and compound interest can make!

So having a guerilla on your back at graduation may not only affect one’s ability to get married and purchase a home — it also has major ramifications on these graduates ability to retire and what their standard of living will be like when they do retire.

Also see:

- You’re spending your millions $1 at a time — from beginnersinvest.about.com

A lesson in the time value of money

Very relevant addendum on 3/26/14:

- Is Student Loan Debt Killing the American Dream? — from linkedin.com by Jill Schlesinger, Business Analyst at CBS News